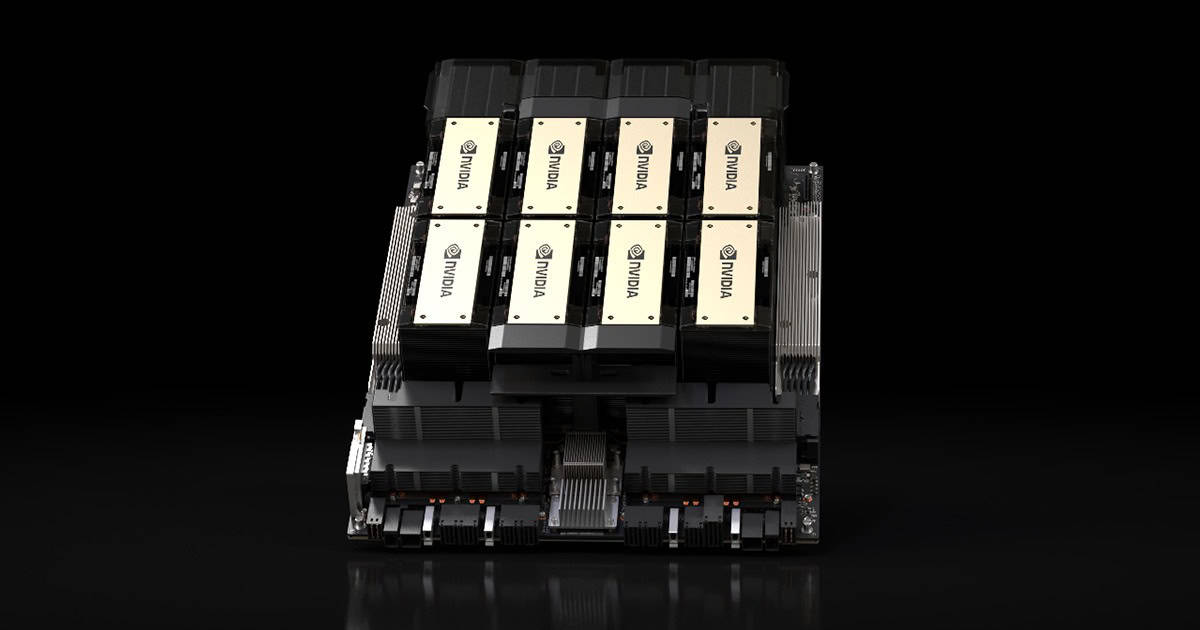

Nvidia’s H20 chip has become a focal point in the complex relationship between U.S. technology and China’s AI ambitions. As the most advanced chip Nvidia can legally sell to China, the H20 represents a careful balance between trade restrictions and business interests. These specialized AI accelerators were designed specifically for the Chinese market after stricter U.S. export controls limited access to Nvidia’s most powerful chips.

The story of the H20 chip highlights the challenges tech companies face in global markets. Nvidia created these chips as a response to U.S. regulations that began in 2022, which cut off Chinese customers from buying their top-tier AI processors. Despite being less powerful than Nvidia’s leading products, the H20 remains highly capable and important for China’s growing AI sector.

Recent developments have brought more uncertainty about the H20’s future. Reports suggest the Trump administration backed off from a potential crackdown on these chips, while Nvidia faces significant financial impacts from ongoing restrictions. The company reportedly took a $5.5 billion charge related to these limitations on China sales, showing how government policies directly affect tech business outcomes.

Why the H20 Chip Matters

The H20 is part of NVIDIA’s next-gen line of AI chips designed to serve enterprise clients with demanding inference workloads. Unlike the powerhouse H100 (which excels at training large language models), the H20 focuses on inference — the real-world application of trained AI models — making it ideal for sectors like finance, healthcare, logistics, and customer service.

What sets the H20 apart:

- 20% faster inference performance than the H100 in several benchmarks

- Designed to meet previous U.S. export compliance thresholds

- Integrates high-speed NVLink for efficient data throughput

- Optimized for AI model deployment at scale

These capabilities made it especially appealing to Chinese tech giants looking to scale generative AI applications across massive user bases.

Who Ordered the H20 — And Why It Caused Concern

The demand for the H20 in China exploded, with reports showing over $16 billion worth of orders from companies like ByteDance, Alibaba, and Tencent. These firms were preparing for long-term AI development and viewed the H20 as a safer bet than the restricted H100 or A100 chips.

But the U.S. government flagged the H20’s connectivity and performance capabilities as potentially violative of export restrictions, particularly regarding:

- Use in data center clusters

- Potential assembly into AI supercomputers

- Applications with military or national security relevance

This triggered an immediate reevaluation by U.S. regulators, leading to abrupt policy shifts.

U.S. Export Crackdown: What Happened?

On April 15, 2025, NVIDIA announced it had been hit with indefinite export licensing requirements on the H20 chips. The decision came after the U.S. government determined the H20’s specifications — especially its NVLink high-bandwidth interconnect — could potentially aid in constructing supercomputing systems in China.

Breakdown of Immediate Impacts

| Impact Area | Details |

|---|---|

| Financial Hit | $5.5 billion charge in Q1 2026 for unsold H20 inventory and contracts |

| Stock Drop | Nearly 7% decline in NVIDIA shares after the announcement |

| Customer Fallout | Chinese customers were caught off guard — some learned via the media |

| Industry Fallout | AMD’s MI308 chip also impacted, with an $800 million write-down |

Chart: NVIDIA’s Reported China Orders vs. Restrictions

| Chinese Company | Estimated Order Value | Impact of New Restrictions |

|---|---|---|

| ByteDance | ~$5 billion | Order likely canceled |

| Alibaba | ~$6 billion | On hold |

| Tencent | ~$5 billion | May seek local alternatives |

Totaling roughly 1.3 million units, these pre-orders were likely part of a strategic stockpile before future restrictions kicked in — an effort now abruptly derailed.

Enterprise Uncertainty & The Global AI Chip Race

For enterprise clients worldwide, the H20 debacle creates ripple effects far beyond China. Companies are now:

- Reassessing AI supply chains

- Accelerating onshore AI chip sourcing

- Watching China’s emerging competitors, particularly Huawei and Alibaba’s in-house silicon teams

Additionally, the move reinforces the fragility of cross-border AI infrastructure and raises concerns about how geopolitical tensions may shape tech stacks in the years ahead.

NVIDIA’s Response & Strategic Pivot

CEO Jensen Huang flew to Beijing in the days following the announcement, aiming to maintain dialogue with key Chinese stakeholders. While there, he emphasized:

- NVIDIA’s ongoing commitment to China

- Willingness to work within new U.S. guidelines

- Focus on custom solutions that may fit export parameters

Simultaneously, NVIDIA revealed plans to invest $500 billion over the next four years in U.S.-based AI infrastructure — signaling a dual-track strategy of growing domestic capacity while cautiously navigating international markets.

What’s Next for H20 and the Enterprise AI Landscape

With the H20 caught in the middle of geopolitics, the question now shifts to what’s next for high-performance inference chips. Companies dependent on cloud AI may pivot toward:

- Onshore data centers

- Partnering with U.S.-compliant suppliers

- Custom chip design collaborations

Others may take a wait-and-see approach as NVIDIA and U.S. policymakers work toward clarification on export rules and potential chip revisions.

Key Takeaways

- Nvidia’s H20 chip was created specifically to comply with U.S. export rules while still serving the Chinese AI market.

- Recent policy shifts have created uncertainty about future sales of these specialized chips to China.

- The export restrictions on advanced AI chips have caused significant financial impact for Nvidia, including a reported $5.5 billion charge.

Overview of Nvidia H20 Chips

The Nvidia H20 chips represent a specialized AI chip designed specifically for the Chinese market in response to export restrictions. These chips serve as a modified version of Nvidia’s more powerful offerings, created to comply with U.S. export controls while still providing AI capabilities to Chinese customers.

Key Features and Technical Specifications

The H20 chip is designed as a less powerful alternative to Nvidia’s top-tier AI processors. While specific technical details are limited, the H20 is engineered to balance performance capabilities with export compliance. The chip supports AI workloads but with deliberately reduced processing power compared to Nvidia’s premium offerings.

These chips can handle AI model training, though not at the same level as Nvidia’s unrestricted products. The technical specifications were carefully calibrated to meet the thresholds set by U.S. export controls, particularly those developed under the Biden administration.

Nvidia created the H20 as part of a family of export-compliant chips, positioning it as the most advanced AI chip the company could legally export to China under previous rules.

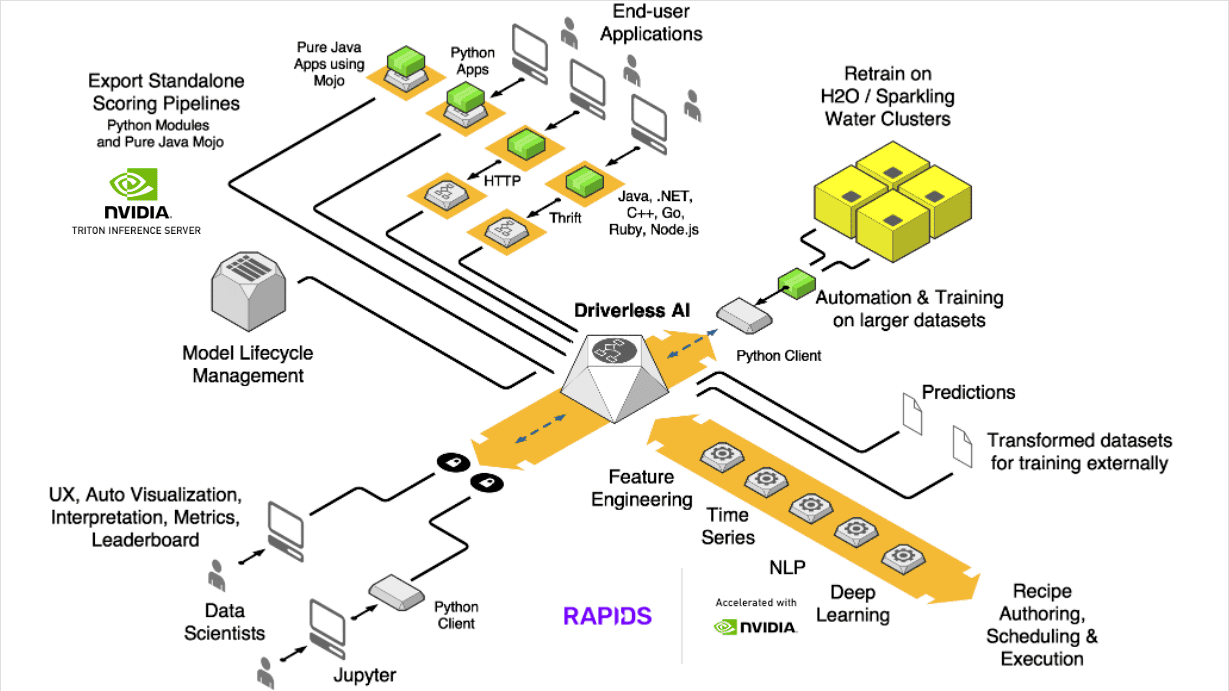

Role in Artificial Intelligence and Supercomputing

The H20 chip plays a critical role in China’s AI ecosystem, offering a pathway for Chinese companies to access Nvidia’s AI technology despite growing restrictions. These chips support various AI applications, though with performance limitations compared to unrestricted models.

For Chinese supercomputing efforts, the H20 represents a compromise solution that allows continued development while respecting international trade regulations. The chips enable AI model training and inference, essential processes for building artificial intelligence systems.

Recent developments have complicated the H20’s position. As of April 2025, Nvidia announced it would take a $5.5 billion charge due to new licensing requirements for H20 exports to China, signaling tightening restrictions on even these modified chips.

Comparison With Competing Solutions

In the Chinese market, the H20 chips face competition from domestic alternatives being developed to reduce reliance on U.S. technology. Chinese companies have been investing heavily in homegrown chips to counter export restrictions.

Compared to AMD and Intel offerings, Nvidia’s H20 chips have maintained a technical edge in AI workloads, despite their reduced capabilities. This advantage stems from Nvidia’s specialized architecture optimized for AI processing.

However, the competitive landscape is shifting rapidly. The recent application of license requirements for H20 chips may create opportunities for companies with fewer export restrictions to gain market share.

The value proposition of H20 chips has been compromised by these regulatory changes, potentially leading Chinese customers to explore alternatives from other international suppliers or accelerate development of domestic solutions.

Market Impact and Regulatory Landscape

Nvidia’s H20 chips have become a focal point in the complex intersection of technology, trade policy, and international relations. Recent export restrictions have significantly altered the availability of these AI accelerators in global markets, especially in China.

H20 Chips in the Chinese AI Market

The H20 chip represents Nvidia’s primary AI offering legally available for the Chinese market following U.S. export controls. Chinese tech companies have placed substantial purchase commitments for these chips, with estimates suggesting orders worth approximately $16 billion for over 1.3 million units.

For Chinese AI developers, the H20 provides crucial computing power while complying with U.S. regulations. The chip was specifically designed to meet performance thresholds set by American export policies.

However, recent reports indicate some Chinese customers were kept in the dark about new regulatory developments affecting these chips. This communication gap has created uncertainty in the market and potentially damaged business relationships.

The availability of H20 chips directly impacts China’s ability to advance its domestic AI industry, making these components strategically important in the larger technology landscape.

Export Controls and Global Trade Implications

U.S. export restrictions on Nvidia’s AI chips have evolved rapidly, creating a complex regulatory environment. The Commerce Department recently added license requirements for H20 exports, significantly impacting Nvidia’s ability to sell to Chinese customers.

These controls reflect growing concerns about advanced technology transfer to China. The restrictions specifically target chips that could enhance Chinese military capabilities or surveillance systems.

The changing regulations have created supply chain disruptions affecting not just Nvidia but also manufacturing partners like TSMC and testing companies such as Advantest.

Trade tensions have intensified as the restrictions expanded from the initial limitations to include more chip variants. This regulatory uncertainty has forced technology companies to continuously adjust their global strategies.

The restrictions exemplify how semiconductor trade has become a key battleground in U.S.-China tensions, with implications extending beyond just the companies directly involved.

Financial Performance and Investment Insights

Nvidia has publicly acknowledged a potential $5.5 billion negative impact from the latest export restrictions. This figure represents a significant portion of their expected revenue from the Chinese market.

The company’s stock performance on Nasdaq has shown volatility following announcements of new export controls. Investors are closely monitoring how Nvidia adapts its business strategy to these changing regulations.

In SEC filings, Nvidia has disclosed the material risks these export controls pose to their business model. The company is actively developing region-specific products to maintain market access while complying with regulations.

Financial analysts, including those at Jefferies, have adjusted their projections for Nvidia based on these regulatory developments. Despite challenges, many maintain positive long-term outlooks given the growing global AI market.

The situation highlights how regulatory decisions can directly impact financial performance even for technology leaders with dominant market positions.

Frequently Asked Questions

Many people have questions about Nvidia’s H20 chips, especially with recent export control issues and their performance capabilities. Below are answers to some common questions about these AI-focused GPUs.

What are the performance benchmarks for the Nvidia H20 graphics processing units?

The H20 chips show strong performance in AI inference tasks, though they are designed with reduced capabilities compared to the H100 and H200 models. These chips have slower interconnection speeds and lower bandwidth than their more powerful siblings.

Benchmark tests indicate the H20 performs well for its target market, offering a good balance between processing power and export compliance. The chip maintains enough AI processing capability to handle most inference workloads efficiently.

How do Nvidia H20 chips compare to their predecessors in terms of energy efficiency?

H20 chips provide better energy efficiency than previous generation Nvidia AI processors. They’re built on the Hopper architecture released in 2022, which brought significant improvements in performance-per-watt metrics.

The power efficiency gains come partly from design choices made to comply with export restrictions. With reduced interconnection speeds, the chips generate less heat while still delivering solid AI performance for inference tasks.

What are the target applications and use cases for Nvidia H20 GPUs?

H20 chips are primarily designed for AI inference workloads in data centers. They excel at running already-trained AI models rather than the more intensive training process.

These GPUs were specifically created for the Chinese market while complying with US export controls. They support a wide range of AI applications including natural language processing, computer vision, and recommendation systems.

Business applications include customer service AI, content moderation, and data analytics that require less power than full AI training but still need significant computing resources.

What is the expected release date for the latest Nvidia H20 series GPUs?

The H20 chips have already been developed and were scheduled for release to the Chinese market. However, there have been complications due to changing US export policies.

Recent reports show confusion around the release timeline, with the US government initially allowing export and then requiring Nvidia to obtain a license to export H20 chips to China. This regulatory back-and-forth has created uncertainty about the actual availability date.

How does the pricing of Nvidia H20 GPUs compare with competitive products in the market?

Specific pricing details for H20 chips haven’t been widely publicized. However, Nvidia has disclosed a $5.5 billion charge related to these chips, suggesting significant investment in their development and production.

The chips are likely priced competitively for the Chinese market, especially considering they were designed specifically to navigate export restrictions while still providing valuable AI capabilities.

What are the implications of Nvidia H20 chips on Nvidia’s stock performance?

The H20 situation has created volatility in Nvidia’s stock. The company’s disclosure of a $5.5 billion charge related to these chips caused concern among investors.

Export restriction changes have further complicated matters, with mixed signals from regulators about whether Nvidia can sell these chips to the Chinese market. This uncertainty has influenced investor confidence in Nvidia’s ability to maintain its strong position in the Chinese AI market.

The stock impact reflects broader tensions between US technology export policies and Nvidia’s global business strategy, particularly in China which represents a major market for AI hardware.