Taiwan’s semiconductor industry faces a potential shakeup as U.S. President Donald Trump threatens to impose tariffs on chips from the island nation. This move could significantly impact Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest contract chipmaker. Trump’s proposal of 25% to 100% tariffs on Taiwan-made chips aims to bring chip manufacturing back to the United States.

The Taiwanese government has responded to these threats, emphasizing that the chip business between Taiwan and the U.S. is a win-win situation. Taiwan’s presidential office stated that the two countries have “good mutual trust and a close relationship” in high-tech cooperation. This highlights the complex nature of the global semiconductor supply chain and the interdependence between nations in this crucial industry.

TSMC, a key player in this unfolding scenario, has not commented on Trump’s tariff remarks. The company’s response to potential U.S. tariffs could have far-reaching implications for the global technology supply chain, as TSMC produces chips for major tech companies worldwide. The situation underscores the delicate balance between national interests and the interconnected nature of the modern tech industry.

The Future of Semiconductors: Taiwan’s Tightrope Walk

The Tariff Threat and TSMC’s Dominance

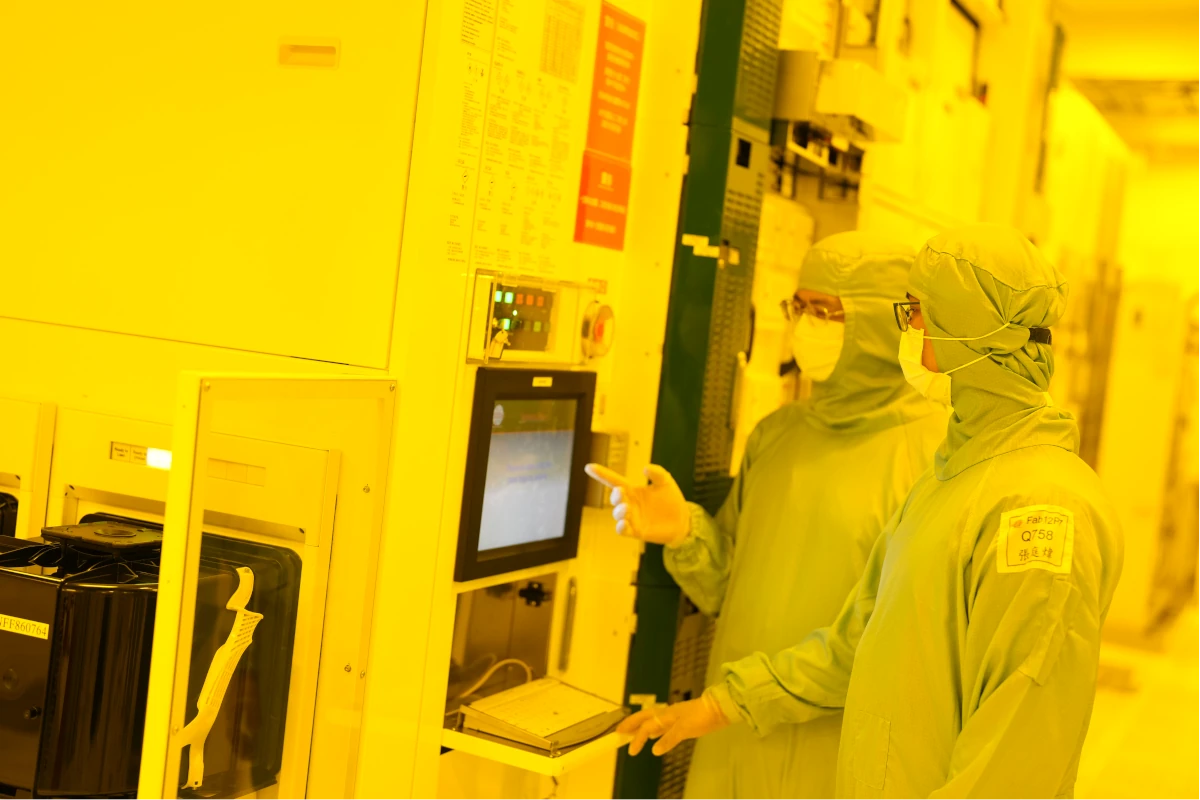

The semiconductor industry, a cornerstone of modern technology, faces a potential shake-up. Discussions surrounding tariffs on goods from Taiwan, particularly semiconductors, have put the spotlight on Taiwan Semiconductor Manufacturing Company (TSMC). TSMC holds a dominant position in the global chip manufacturing landscape. Major tech companies, including Apple, AMD, and Nvidia, rely on TSMC to produce their advanced chips. Any disruption to TSMC’s operations could have ripple effects throughout the tech world. The proposed tariffs aim to incentivize domestic chip production in the United States. This could directly impact TSMC’s bottom line, as their chips would become more expensive for U.S. companies to import.

Taiwan’s Response: A “Win-Win” Narrative

Taiwan emphasizes the mutually beneficial nature of its semiconductor trade with the United States. They highlight the “U.S.-designed, Taiwan-foundry model” as a prime example of this win-win partnership. Taiwan argues that tariffs would harm both economies, disrupting established supply chains and increasing costs for consumers. They point to TSMC’s substantial investments in U.S. manufacturing facilities as a sign of their commitment to the American market. TSMC is investing $65 billion in Arizona. This shows a proactive effort to address concerns about domestic chip production in the US.

Potential Impacts: Ripple Effects Across Industries

The impact of tariffs on Taiwanese semiconductors is significant. Higher chip prices could cause electronics, like smartphones, laptops, cars, and gaming consoles, to become more expensive. There is also the risk of supply chain problems. Companies may need to look for other chip sources, which could lead to delays and product shortages.

While tariffs might encourage more chip manufacturing in the U.S., this would take time and a lot of money. The effects of tariffs on TSMC’s chips would affect many technology companies. Those that depend heavily on TSMC for their advanced chips would face the most risk.

Apple: The iPhone’s Vulnerability

Apple, a major customer of TSMC, relies on the Taiwanese foundry for the A-series chips that power iPhones and iPads. Tariffs would directly increase Apple’s production costs, potentially leading to higher prices for their devices. This could impact Apple’s competitiveness and profit margins. While Apple has been exploring diversifying its chip sources, shifting away from TSMC entirely would be a complex and time-consuming process.

AMD and Nvidia: Graphics Power at Stake

AMD and Nvidia, key players in the graphics processing unit (GPU) market, also depend on TSMC for their high-performance chips. Tariffs would make these chips more expensive, affecting the pricing and competitiveness of their graphics cards. This could impact gamers, content creators, and other users who rely on powerful GPUs.

Qualcomm: Mobile Connectivity in Question

Qualcomm, a leading provider of mobile processors and modems, also sources chips from TSMC. Tariffs could increase the cost of their chips, potentially affecting the prices of smartphones and other mobile devices. This could impact the entire mobile ecosystem, from device manufacturers to consumers.

Other Tech Companies: A Widespread Impact

The impact would extend beyond these major players. Numerous other tech companies, from smaller startups to established corporations, rely on TSMC for various chips used in their products. Tariffs would create a ripple effect throughout the tech industry, impacting a wide range of devices and services.

Intel: A Complex Situation

Intel’s situation is more complex. While Intel is a major chip manufacturer itself, it also relies on TSMC for some of its chip production. This means Intel would be affected by tariffs on TSMC’s chips. However, Intel also stands to potentially benefit from tariffs, as they could make Intel’s domestically produced chips more competitive. The tariffs could incentivize companies to choose Intel’s manufacturing services over TSMC’s, boosting Intel’s foundry business. Intel is pushing hard to get more business as a contract chip manufacturer so any impact on TSMC will affect Intel. This is a double-edged sword for Intel, making it a company to keep a close eye on as the tariff situation unfolds. Intel’s CEO, Pat Gelsinger, has been quite vocal about the need for more domestic chip manufacturing in the U.S. and has pushed for government subsidies for chip factories. The tariffs could be a boon for Intel’s ambitions.

Comparing Options: Domestic vs. International Production

The tariff debate highlights the ongoing tension between domestic production and globalized supply chains. Proponents of domestic production argue that it strengthens national security and reduces reliance on foreign suppliers. However, domestic production can be more expensive, potentially leading to higher prices for consumers. Globalized supply chains offer cost advantages but can be vulnerable to geopolitical risks.

| Feature | Domestic Production | International Production |

|---|---|---|

| Cost | Higher | Lower |

| Supply Chain | More Secure | Potentially Vulnerable |

| Innovation | Can be slower | Often Faster |

| National Security | Stronger | Weaker |

The Future of Chip Manufacturing: A Balancing Act

The semiconductor industry is at a crossroads. The potential tariffs on Taiwan represent a significant challenge, but also an opportunity. TSMC and other chip manufacturers must balance global ambitions with geopolitical realities. Governments are increasingly focused on securing their chip supplies, leading to a more fragmented and complex landscape. The future of chip manufacturing will likely involve a combination of domestic production and international collaboration, with companies strategically diversifying their manufacturing locations.

The Geopolitical Landscape: Taiwan’s Strategic Importance

Taiwan’s strategic importance in the global semiconductor industry cannot be overstated. Its dominance in chip manufacturing gives it significant leverage in international relations. Any conflict involving Taiwan could have catastrophic consequences for the global economy, disrupting chip supplies and impacting countless industries. This makes the Taiwan issue a critical factor in global geopolitics.

Beyond Tariffs: Other Challenges for the Chip Industry

Beyond tariffs, the semiconductor industry faces other challenges. These include the rising costs of chip manufacturing, the increasing complexity of chip design, and the growing demand for chips across various sectors. The industry also faces a shortage of skilled workers, which could hinder future growth. Addressing these challenges will require collaboration between governments, companies, and educational institutions.

The semiconductor industry is crucial to the modern world. The future of this industry depends on navigating complex geopolitical factors, technological advancements, and economic realities. The potential tariffs on Taiwan are just one piece of this complex puzzle.

The CHIPS Act and US Semiconductor Manufacturing

The CHIPS and Science Act, enacted in the United States in 2022, aims to boost domestic semiconductor manufacturing. The act provides billions of dollars in incentives for companies to build chip factories in the U.S. This initiative is a direct response to concerns about supply chain vulnerabilities and the need to reduce reliance on foreign chip makers. The CHIPS Act has attracted significant investment from companies like Intel, Samsung, and TSMC, who are building new fabs in the U.S. The long-term impact of the CHIPS Act on the global semiconductor landscape remains to be seen, but it represents a significant effort by the U.S. to reassert its leadership in this critical industry.

Key Takeaways

- Trump proposes tariffs up to 100% on Taiwan-made chips, targeting TSMC

- Taiwan emphasizes mutual benefits of U.S.-Taiwan semiconductor cooperation

- Potential tariffs could disrupt global tech supply chains and impact U.S. companies

Impact of US Tariffs on Taiwan’s Semiconductor Sector

Potential US tariffs on Taiwan’s semiconductor exports could significantly disrupt the global technology supply chain. This move would affect major tech companies, alter trade dynamics, and influence high-tech cooperation between Taiwan and the US.

Examining Trade Surplus and Deficits

Taiwan’s semiconductor industry has contributed to a substantial trade surplus with the United States. This imbalance has led to concerns about unfair trade practices. The proposed tariffs aim to address this issue by incentivizing chip production within the US.

Key points:

- Taiwan’s semiconductor exports to the US are a major contributor to the trade surplus

- Tariffs could range from 25% to 100% on Taiwan-made chips

- The move is designed to reduce US trade deficits and boost domestic chip manufacturing

Consequences for Major Tech Companies

US-based tech giants heavily rely on Taiwan’s semiconductor industry, particularly TSMC. Tariffs would impact their supply chains and potentially increase costs for consumers.

Affected companies include:

- Nvidia

- Apple

- Intel

- AMD

- Qualcomm

These firms may need to reevaluate their chip sourcing strategies or absorb higher costs. This could lead to price increases for consumer electronics and reduced competitiveness in global markets.

The Role of the CHIPS Act

The CHIPS and Science Act plays a crucial role in this scenario. It aims to boost US semiconductor manufacturing and reduce reliance on foreign chip suppliers.

Key aspects:

- $52 billion in subsidies for domestic chip production

- Tax incentives for semiconductor manufacturing investments

- Research and development funding for advanced technologies

The Act’s implementation could influence the severity and timing of potential tariffs on Taiwan-made chips.

Taiwan-US High-Tech Cooperation

Despite tariff threats, Taiwan emphasizes the mutual benefits of semiconductor cooperation with the US. The island’s economy ministry highlights the complementary nature of their relationship in the tech sector.

Cooperation aspects:

- Technology transfers and joint research initiatives

- US companies’ reliance on Taiwan’s advanced foundry capabilities

- Potential for collaborative efforts to maintain global competitiveness

The challenge lies in balancing US domestic manufacturing goals with the need for Taiwan’s expertise and production capacity in the global semiconductor supply chain.

TSMC’s Strategic Responses and Global Implications

Taiwan Semiconductor Manufacturing Co (TSMC) faces potential US tariffs. The company has developed strategies to address this challenge and maintain its position in the global tech supply chain.

Expansion and Diversification

TSMC is expanding its operations beyond Taiwan. The company is building new manufacturing facilities in Arizona, USA. This move aims to reduce reliance on Taiwan-based production.

TSMC’s Arizona plant will produce advanced 5-nanometer chips. The facility represents a significant foreign direct investment in the US semiconductor industry.

The company is also exploring opportunities in other countries. This diversification strategy helps TSMC mitigate risks associated with geopolitical tensions.

Mutual Trust and Trade Relations

TSMC is working to strengthen relationships with key stakeholders. The company maintains open communication channels with both US and Taiwanese governments.

Regular dialogues help address concerns about technology transfers and supply chain security. TSMC emphasizes its commitment to fair trade practices and intellectual property protection.

The company collaborates with global partners to ensure a stable supply of critical components. These efforts contribute to building mutual trust in high-tech cooperation.

Transparency in Technology Production

TSMC has increased transparency in its manufacturing processes. The company provides detailed information about its production capabilities and technology roadmap.

This openness helps alleviate concerns about potential security risks. TSMC implements strict controls to prevent unauthorized access to sensitive technologies.

The company also participates in industry-wide initiatives to promote responsible semiconductor manufacturing. These actions demonstrate TSMC’s commitment to maintaining its role as a trusted global technology provider.