Nvidia currently leads the AI chip market, but new competitors are entering the field. As technology evolves, Nvidia may face challenges in maintaining this leadership in 2025. While Nvidia still offers powerful AI chips, competition is increasing and could create new obstacles. To stay successful, Nvidia will need to adapt its strategies. It will be important for the company to balance innovation with strong customer relationships as regulatory rules and technology change. As the AI market grows, many will watch to see how Nvidia uses its strong position to deal with new threats in this fast-paced industry.

Nvidia’s AI Dominance: Will it Continue in 2025?

Nvidia has been a dominant force in the AI chip market, but the landscape is shifting. Will their chips continue to outshine the competition in 2025? Let’s examine the factors at play.

Nvidia’s Current Strengths

Nvidia’s success stems from several key advantages:

- Early Investment: Nvidia recognized the potential of GPUs for AI early on and invested heavily in software and ecosystem development. This gave them a significant head start.

- CUDA Platform: Nvidia’s CUDA parallel computing platform is widely adopted in the AI research and development community. This creates a strong network effect that makes it difficult for competitors to break in.

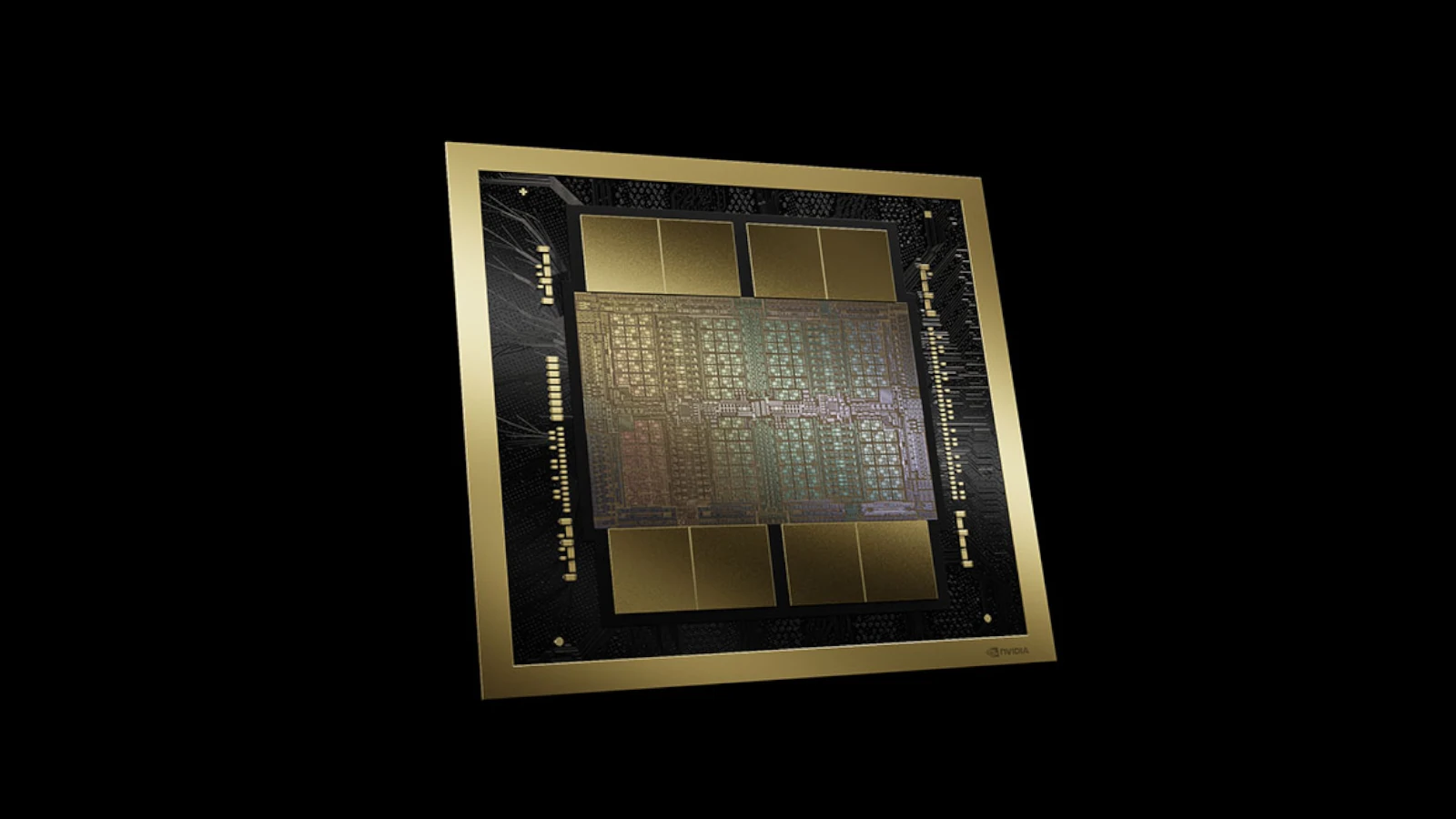

- High-Performance GPUs: Nvidia consistently delivers high-performance GPUs that excel in AI workloads. Their Hopper and Blackwell architectures are expected to maintain this edge.

Challenges and Competition

Despite its strengths, Nvidia faces challenges:

- Increased Competition: Companies like AMD, Intel, and Google are developing their own AI chips and platforms.

- Supply Chain Constraints: Global supply chain issues have impacted Nvidia’s ability to meet demand, creating opportunities for competitors.

- Specialization: Some competitors focus on specific AI niches, potentially offering more tailored solutions.

Key Competitors

Here’s a look at some of Nvidia’s main competitors:

| Competitor | Strengths |

|---|---|

| AMD | Strong gaming GPUs, growing AI presence with Instinct MI300 series |

| Intel | CPU dominance, expanding into GPUs with Ponte Vecchio and Falcon Shores |

| TPUs designed specifically for AI workloads in Google Cloud | |

| Amazon | AWS Inferentia and Trainium chips optimized for cloud AI |

| Startups | Developing innovative AI chip architectures and software |

Nvidia’s Strategy

Nvidia is not standing still. They continue to innovate and expand their offerings:

- New Architectures: Hopper and Blackwell architectures promise significant performance improvements.

- Software Ecosystem: Nvidia continues to invest in its software ecosystem, making its platform more attractive to developers.

- Full-Stack Solutions: Nvidia is moving beyond chips to offer complete AI systems and platforms.

Looking Ahead to 2025

Nvidia is well-positioned for continued success in the AI chip market. However, competition is intensifying. The company that can best meet the evolving needs of AI developers and researchers will likely lead the pack. Factors like performance, efficiency, cost, and software ecosystem will all play a crucial role.

The Broader AI Landscape

The AI chip market is just one piece of the larger AI puzzle. Other important trends to watch include:

- Edge AI: Bringing AI processing closer to the source of data, such as in devices and embedded systems.

- AI Software: Development of new AI algorithms and software frameworks that can take advantage of advanced hardware.

- Ethical Considerations: Addressing concerns about bias, fairness, and responsible use of AI.

These trends will shape the future of AI and influence the demand for different types of AI chips and solutions.

Short Summary:

- Nvidia holds a significant share of the AI chip market but faces increasing competition.

- New innovations from startups and tech giants threaten to disrupt Nvidia’s stronghold.

- Regulatory scrutiny may impact Nvidia’s expansion and market strategies.

Since its inception, Nvidia has transformed from a gaming GPU manufacturer into the powerhouse of the artificial intelligence (AI) chip market. With estimates suggesting that it commands between 70% and 95% of the market for AI accelerators, the company has relied on its cutting-edge technology and strong brand loyalty to maintain its front-runner status. Nvidia’s ascent began in 2012, when Alex Krizhevsky’s groundbreaking work in deep learning utilized Nvidia’s graphics processing units (GPUs) to enhance AI computations. This laid the groundwork for developing powerful AI applications, further anchoring Nvidia’s position in the market.

At the core of Nvidia’s rapid rise are its advanced graphic processing units, particularly the A100 and H100 models, which have become benchmarks in AI technology. These GPUs are extensively used in data centers, universities, and by tech giants for training and deploying large language models (LLMs) and neural networks. As Nvidia’s Chief Executive Officer Jensen Huang noted:

“I probably know they’re trying to put me out of business, so that’s different.”

The company’s CUDA (Compute Unified Device Architecture) platform enables developers to write applications that use parallel computing capabilities of Nvidia chips, enhancing their performance for AI workloads. Integrating its hardware with a strong software ecosystem, Nvidia has made it increasingly difficult for businesses to switch to competing solutions as they build significant infrastructure around their products.

The Ecosystem Advantage

Nvidia’s success extends beyond hardware capabilities. The company has created a robust ecosystem that incorporates software like CUDA, cuDNN, and TensorRT, allowing seamless development and integration for AI-driven applications. These tools are widely adopted by organizations aiming to enhance AI functionalities, further solidifying Nvidia’s industry dominance.

Nvidia’s AI Enterprise provides comprehensive resources for AI development, deployment, and management, facilitating businesses in utilizing AI effectively. The Omniverse platform, for instance, has gained traction among developers creating virtual simulations, broadening Nvidia’s portfolio and reach across different sectors.

Impact of Emerging Competitors

Despite Nvidia’s stronghold in the market, the landscape is beginning to shift. Rivals such as Intel, AMD, and many young startups are pushing into the AI chip sector with their innovations, challenging Nvidia’s supremacy. While Intel has struggled to regain its former dominance, it has launched the Gaudi AI accelerator chip, which promises more cost-effective alternatives to Nvidia’s high-end offerings. Similarly, AMD’s Instinct MI300X GPU has seen adoption from cloud providers, positioning it as a competitor against Nvidia in AI workloads.

Alongside established companies, a fresh wave of startups is emerging, aiming to carve out their niches in the AI hardware space. Organizations like Groq and SambaNova Systems offer specialized AI architectures that promise superior performance in specific tasks, potentially undermining Nvidia’s market share. As Rich Duprey of The Motley Fool noted:

“AI is the real deal, and Nvidia has been one of the primary beneficiaries… but with more competition developing equally powerful chips, Nvidia stock may not be the winning play it once was.”

With AI adoption soaring across industries from healthcare to automotive, the demand for advanced AI chips is rising exponentially. Companies are investing heavily in AI infrastructure to train and deploy cutting-edge models, further fragmenting the landscape. Nvidia’s revenue surged in 2023, reflecting this growth, yet the company cannot afford to remain complacent as competitors innovate aggressively.

Regulatory Concerns on the Horizon

As Nvidia’s market influence grows, so does the scrutiny from regulatory bodies. The U.S. Department of Justice (DOJ) is investigating the company over potential antitrust violations, raising questions about whether Nvidia’s market practices hinder competition. These investigations have already impacted Nvidia’s stock market performance as investors respond to potential repercussions.

Observers note that rivals like Intel and AMD face fewer barriers as they attempt to chip away at Nvidia’s stronghold. The DOJ’s investigation indicates increased regulatory scrutiny on how much control Nvidia holds over AI processing and the challenges faced by its competitors in gaining market access. As Nvidia consolidates its position through acquisitions and innovation, it may face significant hurdles from both regulators and the competitive landscape.

Transitioning to Edge AI

A significant evolutionary shift is underway as AI processing begins to migrate from centralized data centers to edge devices like smartphones, laptops, and IoT devices. Companies like Apple and Qualcomm are Pouring resources into developing specialized processors that can handle AI tasks locally. This trend poses a challenge for Nvidia, as it has primarily focused on data center-centric solutions. The rise of edge computing could diminish the reliance on Nvidia’s high-powered chips for smaller applications.

According to Intel’s roadmap, the company is preparing to capitalize on this transition. Their “AI everywhere” initiative aims to position them as leaders in AI processing across various devices, including entry-level smartphones. Jensen Huang emphasized the importance of adapting to the landscape, stating:

“The transition from training to inference could potentially allow competitors to seize opportunities they hadn’t before.”

A Competitive Threat or Future Collaboration?

With industry titans building their in-house chips, Nvidia faces a dual-edged sword. On one hand, companies like Microsoft, Amazon, and Google, which significantly contribute to Nvidia’s revenue, are developing alternative solutions to reduce dependence on Nvidia’s chips. On the other hand, this could lead to partnerships where these giants utilize Nvidia’s established technologies while integrating their custom solutions. As the computing landscape matures, the survival of the fittest will emerge as tech firms reevaluate their dependency on singular vendors.

Adding to this dynamic, venture capital funding for AI semiconductors reached $6 billion in 2023, with multiple startups benefitting from the growing demand for specialization in AI hardware. Each of these emerging companies—like Graphcore and Cerebras Systems—demonstrates the potential to innovate beyond conventional GPU architectures, repeatedly pushing Nvidia to adapt its strategy.

Financial Dynamics and the Road Ahead

Nvidia’s financials tell a compelling story, with a staggering 78% gross margin relative to its competitors, which boast margins of around 41% and 47%. Such profitability signals the effectiveness of Nvidia’s pricing strategy and market position to investors. The predictions for AI chip revenues point to a market that could surpass $33 billion by the end of 2024, leading competitors to fight tooth and nail for a share of this burgeoning segment.

Despite this, the potential for price erosion exists as competition heats up. Nvidia will need to innovate continuously while also considering how market conditions and customer preferences shift in response to cheaper alternatives entering the fray.

Path to Retaining Market Dominance

A key focus for Nvidia should involve retaining its user base by creating an unyielding ecosystem that integrates hardware and software seamlessly. Consistent yearly innovations in AI chip architecture and regular software enhancements will fortify their position further. By maintaining high-level partnerships across industries, Nvidia can provide comprehensive solutions that meet diverse needs, keeping customers reliant on them for both technology and support.