TSMC is exploring the possibility of taking control of Intel’s U.S. manufacturing facilities, following a request from Trump administration officials. This potential deal could reshape the semiconductor industry by combining TSMC’s advanced manufacturing expertise with Intel’s established U.S. infrastructure.

The move carries significant implications for U.S. chip manufacturing, as Intel is a major employer in states like Oregon where it operates large facilities. This partnership aims to strengthen domestic semiconductor production and reduce reliance on overseas manufacturing.

The proposal aligns with U.S. strategic interests in maintaining technological leadership while presenting operational challenges for both companies. The combination would merge TSMC’s manufacturing excellence with Intel’s established U.S. presence.

Potential TSMC-Intel Collaboration: Opportunities and Challenges

Recent reports indicate that Taiwan Semiconductor Manufacturing Company (TSMC) is considering taking control of Intel’s U.S. factories at the request of President Donald Trump’s administration. This initiative aims to enhance domestic chip production and reduce reliance on foreign manufacturing. While such a partnership could offer significant benefits, it also presents several challenges that both companies must address.

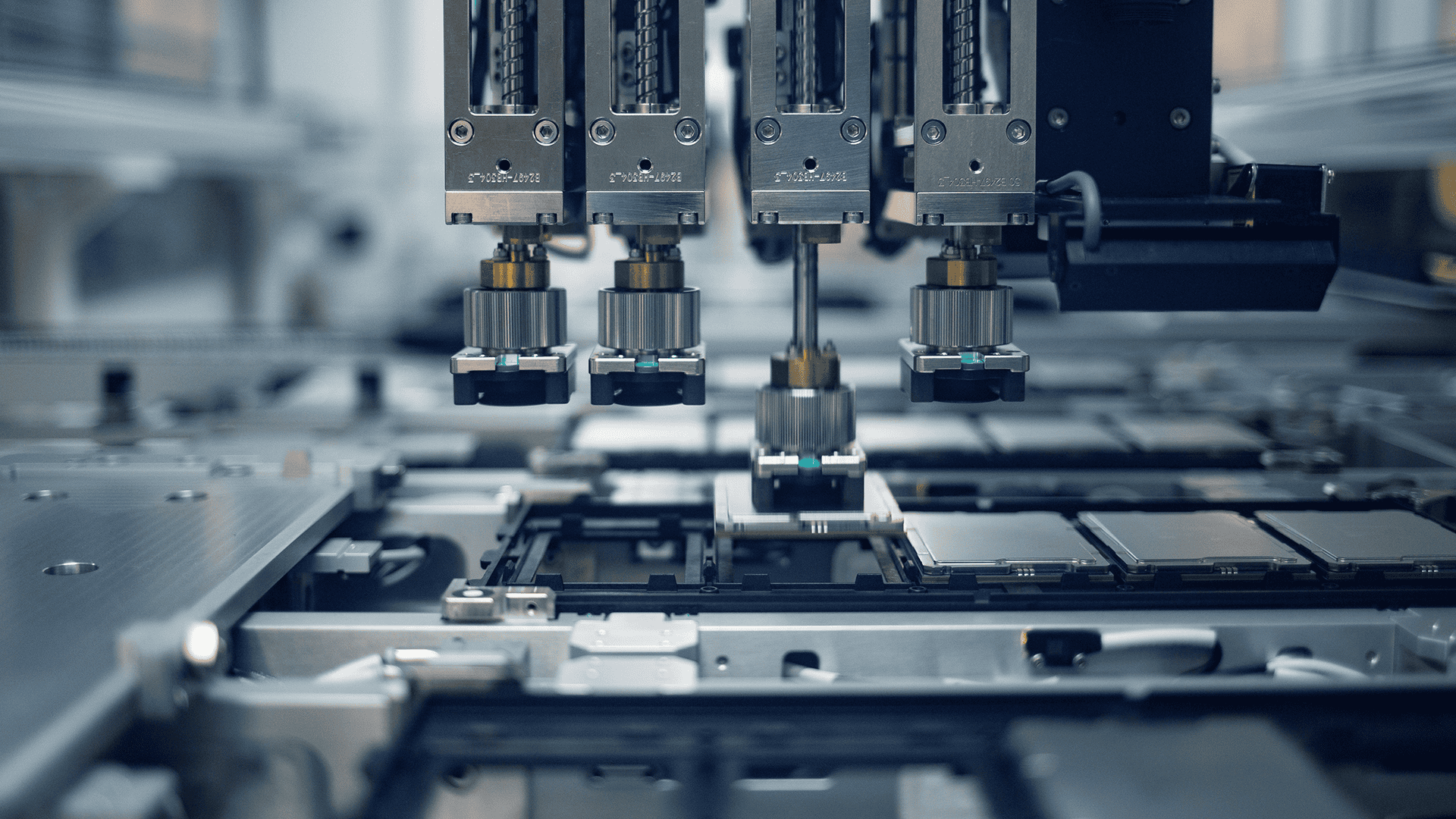

Operational Integration

TSMC and Intel have distinct manufacturing processes. Integrating TSMC’s production techniques into Intel’s existing facilities would require substantial adjustments. This could involve retraining staff, overhauling existing workflows, and potentially sharing proprietary technologies, which may raise concerns about intellectual property and operational efficiency.

Strategic Implications for Intel

If TSMC assumes control of Intel’s manufacturing plants, Intel might shift towards a fabless model, focusing primarily on chip design rather than production. This transition could streamline operations and reduce overhead costs. However, it would also mean relinquishing control over the manufacturing process, which has been a core aspect of Intel’s identity and competitive advantage.

Financial Considerations

Intel has faced financial challenges recently, with its stock experiencing significant fluctuations. A partnership with TSMC could provide a financial boost and stabilize operations. However, the costs associated with integrating different manufacturing processes and potential investments in facility upgrades could be substantial.

Analyst Perspectives

Industry analysts have expressed mixed views on this potential collaboration. Some believe that combining TSMC’s manufacturing expertise with Intel’s infrastructure could position the U.S. as a central player in the global semiconductor industry. Others caution that the complexities of merging different operational methodologies might outweigh the potential benefits, leading to operational inefficiencies and cultural clashes within the workforce.

Alternative Approaches

Instead of taking over Intel’s facilities, TSMC could consider expanding its own manufacturing footprint in the U.S. This approach would align with the goals of increasing domestic chip production without the challenges associated with integrating two distinct operational systems. However, building new facilities requires significant capital investment and time, potentially delaying the intended benefits of boosting domestic production.

Key Considerations

To better understand the potential impact of this collaboration, consider the following factors:

| Factor | Implications |

|---|---|

| Operational Integration | Requires alignment of manufacturing processes and potential sharing of proprietary technologies. |

| Strategic Shift for Intel | Transitioning to a fabless model could streamline operations but reduce control over production. |

| Financial Investment | Significant costs associated with facility upgrades and process integration. |

| Analyst Opinions | Diverse views on the feasibility and benefits of the partnership. |

| Alternative Strategies | Building new TSMC facilities in the U.S. as an alternative to taking over Intel’s plants. |

In summary, while the proposed TSMC-Intel partnership could reshape the semiconductor landscape and bolster U.S. chip production, it presents a range of operational, strategic, and financial challenges. Both companies will need to carefully evaluate these factors to determine the most viable path forward.

Exploring the CHIPS and Science Act

The CHIPS and Science Act, enacted to strengthen domestic semiconductor manufacturing, offers incentives for companies to produce chips within the U.S. This legislation aims to reduce dependency on foreign suppliers and enhance national security. Companies like TSMC and Intel stand to benefit from subsidies and grants provided under this act, which could offset some costs associated with expanding or upgrading manufacturing facilities. However, challenges such as a shortage of skilled workers and high construction costs in the U.S. may impact the effectiveness of these incentives. Addressing these issues is crucial for the successful implementation of the act’s objectives.

The recent consideration by TSMC to take over Intel’s U.S. factories highlights a significant shift in the semiconductor industry. This move, prompted by the Trump administration’s push for increased domestic chip production, underscores the strategic importance of onshore manufacturing capabilities. While the potential partnership offers opportunities for operational synergy and financial stabilization, it also presents challenges related to process integration and strategic realignment. As both companies navigate these complexities, the outcome could redefine their roles in the global semiconductor landscape.

Key Takeaways

- TSMC may acquire control of Intel’s U.S. factories at the Trump administration’s request

- The potential merger would strengthen U.S. domestic chip manufacturing capabilities

- This deal could create a powerful new force in semiconductor production by combining two industry leaders

Background on TSMC and Intel

TSMC and Intel represent two powerhouses in semiconductor manufacturing, with distinct strengths in contract manufacturing and integrated chip design.

TSMC’s Global Presence and Expertise

TSMC stands as the world’s largest contract chip manufacturer, producing chips for major tech companies like Apple, AMD, and NVIDIA. The company controls over 50% of the global foundry market.

TSMC’s advanced manufacturing processes lead the industry, with capabilities to produce 3-nanometer chips. Their fabrication plants span multiple countries, with primary operations in Taiwan.

The company invests heavily in research and development, spending $4.3 billion in 2024 alone. Their technological edge makes them a critical partner for American chip designers.

Intel’s Position in the Semiconductor Industry

Intel has dominated x86 processor manufacturing for decades, maintaining both design and manufacturing capabilities. The company operates major fabrication facilities across the United States, including sites in Arizona, Oregon, and New Mexico.

Recent years have brought challenges to Intel’s manufacturing leadership. Competitors have surpassed their process technology, leading to strategic shifts in their business model.

Intel employs over 120,000 people worldwide and remains Oregon’s largest corporate employer. Their factories produce chips for their own designs and have recently opened to manufacturing for other companies.

The company’s foundry services division aims to compete with TSMC by offering manufacturing capabilities to external customers.

Implications of TSMC Taking Over Intel’s US Factories

The potential TSMC takeover of Intel’s US factories represents a significant shift in semiconductor manufacturing, with implications for national security and technological leadership.

Potential Benefits for the US Semiconductor Sector

Intel’s largest corporate employer status in several states makes this partnership crucial for American manufacturing jobs.

TSMC’s advanced manufacturing expertise could revitalize Intel’s facilities. Their technological processes could boost production efficiency and yield rates.

The partnership would strengthen domestic chip production, reducing US dependence on foreign semiconductor imports. This aligns with CHIPS Act goals of enhancing American semiconductor capabilities.

Federal subsidies and grants would support the transition, providing:

- Financial support for facility upgrades

- Job training programs

- Research and development funding

Strategic Advantages for TSMC

TSMC gains immediate access to established US manufacturing infrastructure through this arrangement. This eliminates years of construction time for new facilities.

The deal provides TSMC with:

- Geographic diversification away from Taiwan

- Enhanced market access in North America

- Stronger relationships with US government and tech companies

Trump administration officials’ support indicates favorable regulatory treatment for TSMC’s expansion plans.

The partnership reduces TSMC’s reliance on Asian facilities while strengthening its global competitive position against other semiconductor manufacturers.