Adding a card to Apple Pay is easy, but sometimes you need to verify it with your bank. This extra step keeps your money safe. The Apple Pay bank verification process usually involves a phone call, text message, email, or in-app check with your bank or card company.

Some banks make you call them to verify your card for Apple Pay. Bank of America is one of these. When adding a Bank of America card, you may need to call the bank to finish setting it up. Other banks let you verify by text or email, which is often quicker.

If you have trouble verifying your card, ask your bank for help. They can guide you through the steps or fix any issues. Remember, each bank has its own way of checking cards for Apple Pay. The process might be different for each of your cards.

Apple Pay Bank Verification: A Smooth and Secure Process

Setting Up Apple Pay: The First Step

Before you can enjoy the convenience of Apple Pay, you’ll need to link your debit or credit card from a participating bank. This involves a verification process to ensure the security of your financial information. Apple Pay prioritizes security, so this process is designed to protect you from unauthorized use.

The Verification Process: What to Expect

The Apple Pay bank verification process is generally straightforward. Here’s a breakdown of the typical steps:

- Add Your Card: Open the Wallet app on your iPhone or Apple Watch. Tap the “+” button and follow the on-screen instructions to add your debit or credit card. You’ll be asked to enter your card details, including the card number, expiration date, and CVV.

- Bank Verification: Apple will then contact your bank to verify your card. This might involve a few different methods:

- Automated Verification: In many cases, the verification is automatic and happens in the background. You might receive a notification that your card has been successfully added.

- Text Message or Email: Your bank might send you a text message or email with a verification code. You’ll need to enter this code in the Wallet app to confirm your card.

- Phone Call: In some cases, your bank might call you to verify your card. This is less common but might happen for security reasons.

- App Verification: Some banks have their own apps that integrate with Apple Pay. You might be asked to open your bank’s app to complete the verification.

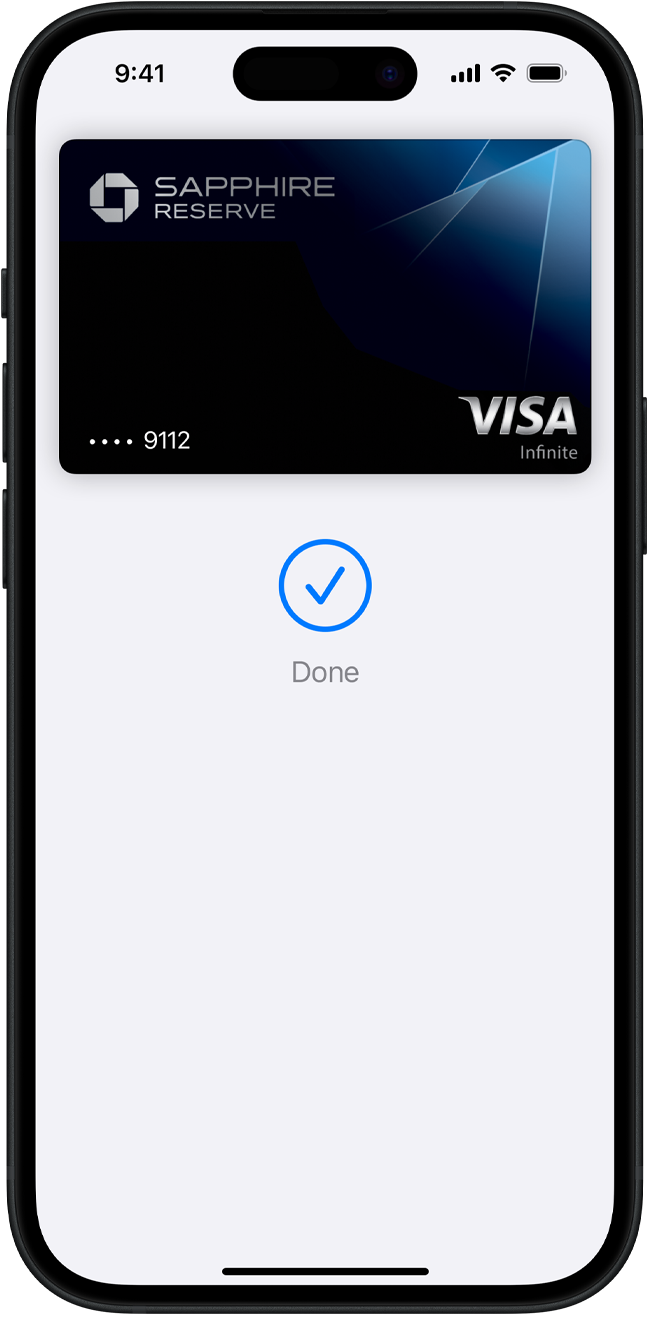

- Completion: Once your card is verified, you’ll be able to start using Apple Pay for contactless payments in stores, online, and in apps.

Troubleshooting Verification Issues

Sometimes, the verification process might encounter hiccups. Here are some common issues and how to address them:

- Incorrect Card Details: Double-check that you’ve entered your card number, expiration date, and CVV correctly. Even a small typo can prevent verification.

- Bank Issues: There might be a temporary issue with your bank’s system. Try again later or contact your bank directly.

- Outdated Contact Information: Make sure your bank has your current phone number and email address on file. This is important for receiving verification codes.

- Card Not Supported: While most major banks support Apple Pay, there might be some exceptions. Check with your bank to confirm that your card is compatible.

Security Measures: Protecting Your Information

Apple Pay employs several security measures to protect your financial information:

- Tokenization: Apple Pay uses tokenization, which means that your actual card number is never stored on your device or shared with merchants. Instead, a unique token is used for each transaction.

- Device Security: Apple Pay requires you to use a passcode, Face ID, or Touch ID to authorize payments, adding another layer of security.

- Fraud Monitoring: Banks have fraud monitoring systems in place to detect any suspicious activity.

Tips for a Smooth Verification Process

- Have your card handy: Keep your debit or credit card nearby during the verification process.

- Check your contact information: Make sure your bank has your correct phone number and email address.

- Be patient: The verification process might take a few minutes.

- Contact your bank: If you encounter any issues, don’t hesitate to contact your bank’s customer support.

Beyond Verification: Maximizing Your Apple Pay Experience

Once your card is verified, you can explore the many features of Apple Pay. You can add multiple cards to your Wallet and choose which card to use for different transactions. You can also use Apple Pay for in-app purchases and online shopping, making it a truly versatile payment method. Consider setting up rewards programs with your cards to earn points or cashback on your Apple Pay purchases. Many retailers also offer exclusive deals and promotions for Apple Pay users. By taking advantage of these features, you can make the most of your Apple Pay experience.

Key Takeaways

- Apple Pay bank verification keeps your money safe

- Verification methods include phone calls, texts, emails, or in-app checks

- Contact your bank if you have trouble verifying your card

Setting Up Apple Pay

Setting up Apple Pay is quick and easy. You can add cards, verify them with your bank, and start using Apple Pay on supported devices in just a few steps.

Adding Your Card to Apple Pay

To add a card to Apple Pay, open the Wallet app on your iPhone. Tap the plus sign to add a new card. You can scan your card with the camera or enter the details manually.

For iPad or Mac, go to Settings or System Preferences. Find the Wallet & Apple Pay section. Select “Add Card” and follow the steps.

On Apple Watch, use the Watch app on your iPhone. Go to the “Wallet & Apple Pay” section and tap “Add Card”.

Verification Requirements by Card Issuers

Banks have different ways to verify your card for Apple Pay. Some send a code by text or email. Others may ask you to call them.

Bank of America often requires a phone call to verify. Other banks let you verify through their mobile app or website.

If you don’t get a verification code, check your email spam folder. You can also contact your bank for help.

Supported Devices for Apple Pay Setup

Apple Pay works on many Apple devices. iPhones with Face ID or Touch ID support it. This includes iPhone 6 and newer models.

iPads with Touch ID or Face ID can use Apple Pay for in-app and web purchases. Most recent iPad models are compatible.

Apple Watch Series 1 and later support Apple Pay. You can add cards through the paired iPhone.

Macs with Touch ID built-in can use Apple Pay. Other Macs can use it when paired with an iPhone or Apple Watch.