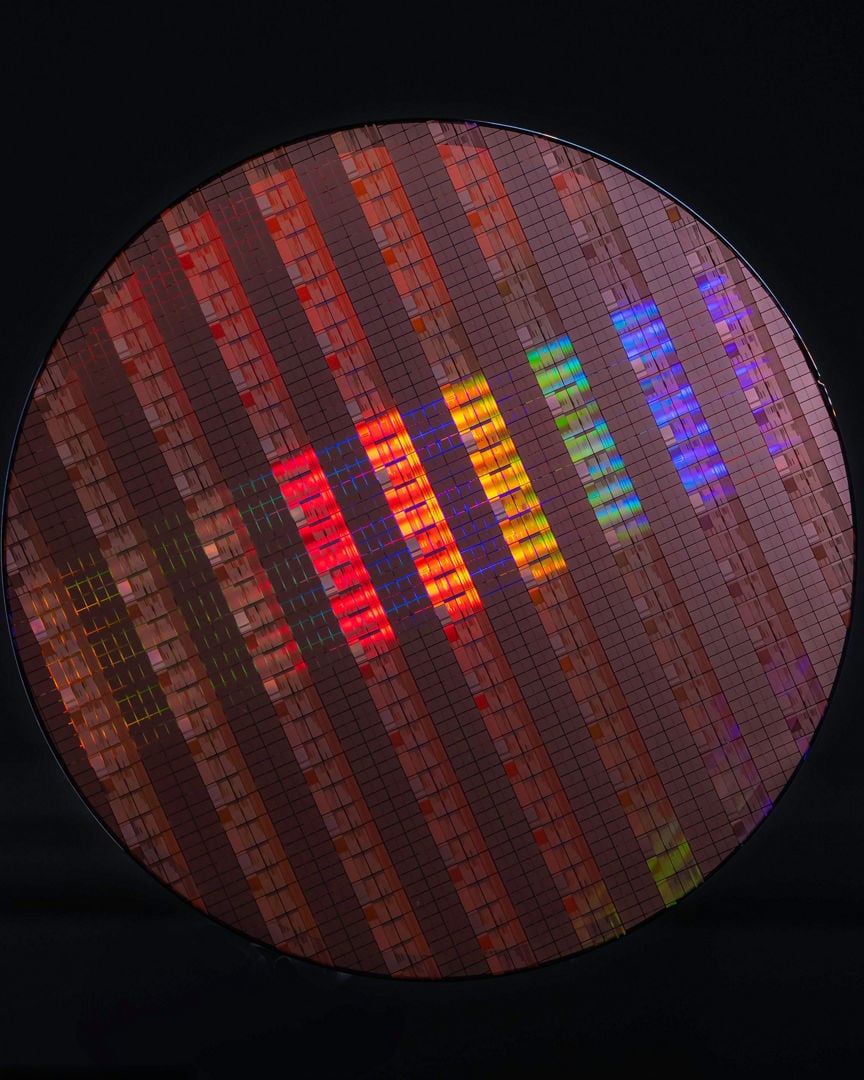

A brewing storm in the semiconductor industry could lead to sharply higher prices for American-made chips. Reports suggest that TSMC — the world’s largest contract chipmaker — may charge up to 30% more for chips produced at its upcoming Arizona fabrication facility. If true, this pricing shift would send ripples through the global tech ecosystem, with profound implications for device makers, developers, and end consumers alike.

Why Is TSMC Considering the Price Hike?

The rumored price increase is tied to several factors:

- Higher U.S. operating costs: TSMC faces increased labor, utility, and logistics expenses in the U.S. compared to Taiwan.

- Domestic manufacturing incentives: While the CHIPS Act offers subsidies, they may not fully offset the financial burden of building and running fabs on American soil.

- Geopolitical strategy: The Arizona facility represents a key part of U.S. efforts to localize chip production amid growing tensions with China. TSMC may see premium pricing as a justifiable cost of regional diversification.

However, TechInsights and other analysts have noted that the actual difference in production costs between Arizona and Taiwan is closer to 10%, not 30%. This raises questions about whether TSMC is leveraging geopolitical urgency and limited U.S. chipmaking capacity to justify higher margins.

The Impact on AMD, NVIDIA, and the Broader Market

Should the 30% price bump become reality, companies like AMD, NVIDIA, Apple, and Qualcomm — all of whom rely heavily on TSMC’s advanced nodes — could face increased bill-of-materials (BOM) costs. These companies may:

- Absorb the extra costs, cutting into their margins.

- Pass costs to consumers via more expensive CPUs, GPUs, and mobile chips.

- Delay or reconsider production localization in the U.S.

In a market already struggling with inflationary pressures, even modest cost increases could compound pricing on finished products like laptops, smartphones, and gaming consoles.

Trade Policy Pressure and TSMC’s Response

Complicating the issue are potential U.S. tariffs on foreign-made semiconductors, which the Biden administration is considering as part of a broader trade recalibration. These tariffs could make Taiwan-made chips more expensive to import, further incentivizing localized production — and giving TSMC greater pricing power for Arizona-made chips.

TSMC has pushed back on this strategy, warning that overly aggressive tariffs or unmet subsidy promises could jeopardize its $65 billion Arizona expansion plan, which includes a roadmap for 3nm and eventually 2nm production in the U.S.

What’s Next?

TSMC has not confirmed the rumored pricing structure, but industry watchers expect clarity by the time the Arizona fabs go operational in 2026. Meanwhile, U.S. lawmakers and chip buyers are under pressure to secure cost-effective and geopolitically resilient supply chains.

If TSMC’s premium pricing becomes standard for domestic production, U.S.-made chips might shift from a competitive advantage to a luxury offering—at least until economies of scale kick in or more foundries join the ecosystem.

For now, the semiconductor sector waits for TSMC’s next move — one that could reshape global pricing dynamics for years to come.

Legal Barriers: Taiwan’s Restrictions on TSMC’s Cutting-Edge Tech Abroad

While TSMC is expanding its global manufacturing footprint, including a multibillion-dollar investment in Arizona, Taiwanese law imposes strict limitations on how far that technology can go. Specifically, Taiwan’s Ministry of Economic Affairs prohibits the export of its most advanced chip manufacturing processes — currently defined as nodes smaller than 12nm — to overseas facilities unless explicitly approved.

This means that while TSMC’s Arizona fab will support advanced nodes like 4nm and eventually 3nm, the company is not legally allowed to manufacture its most cutting-edge 2nm or future 1.4nm process nodes outside of Taiwan — at least under current regulations.

The rationale behind the law is clear: Taiwan sees TSMC’s technological edge as a national security asset. By keeping the most sophisticated chipmaking capabilities on the island, Taiwan aims to maintain geopolitical leverage, protect domestic talent and IP, and avoid the risk of involuntary technology transfer to rival nations or corporate espionage.

For the U.S., this creates a structural limitation. Even as TSMC builds factories on American soil, the absolute bleeding-edge chips — those destined for next-generation AI, datacenter, and military applications — will still be manufactured exclusively in Taiwan. This dependency may undercut efforts by U.S. lawmakers to fully secure the semiconductor supply chain within national borders.

Unless Taiwan modifies its laws or makes case-by-case exceptions, TSMC’s most powerful process technologies will remain a domestic advantage, keeping global chip production — and pricing power — tethered to the island for the foreseeable future.

After Tight Supply and Shortage, AMD CPUs Seem Readily Available Everywhere

The landscape for AMD’s latest gaming CPUs has shifted significantly since launch. What started as a period of tight supply and rapid sellouts has now stabilized, with the Ryzen 9 9900X3D and Ryzen 7 9800X3D widely available, and even the flagship Ryzen 9 9950X3D returning to store shelves. AMD has ramped up shipments in response to massive demand, and all three X3D chips are now easier to find at major retailers including Amazon, Newegg, and Micro Center.

Thanks to AMD’s increased production capacity and expanded partnerships with TSMC (including a future U.S. manufacturing site), the stock situation for the Ryzen 9000 X3D lineup has significantly improved. While the 9950X3D did sell out quickly during its initial release, supply has since normalized. Consumers no longer need to rely on stock trackers or reseller markups.

Gamers and power users are especially drawn to the 9800X3D for its excellent price-to-performance ratio, while professionals tend to favor the 9900X3D for its balance of productivity and gaming muscle. The 9950X3D remains the premium choice, now attainable without the frustrating delays or inflated aftermarket prices that plagued its launch window.

Key Takeaways

- The Ryzen 9 9950X3D is now available again after an initial launch shortage.

- The Ryzen 9900X3D and 9800X3D remain widely in stock and are excellent alternatives.

- AMD has increased CPU shipments to meet sustained high demand across all regions.

Assessing the Availability of AMD’s Latest CPUs

AMD’s Ryzen 9000 X3D series has reached a more stable retail status. Launched in March 2025, these processors quickly gained traction among gamers and creators alike. However, what was once a scramble to find inventory has transitioned into a more consistent buying experience.

Restocked and Rebalanced: The 9950X3D Is Back

Originally retailing at $699, the Ryzen 9 9950X3D disappeared from major retail sites within hours. Now, after AMD scaled up its shipments, the processor is regularly available again. Scalping concerns have diminished, and pricing has largely stabilized at MSRP or slightly above depending on region.

AMD confirmed in recent briefings that it has been shipping more 9950X3Ds weekly and anticipates no long-term shortage. This update was a relief to high-end system builders and DIY enthusiasts who had previously been left waiting or paying premiums on secondary markets.

Strong Inventory for the 9900X3D and 9800X3D

The Ryzen 9 9900X3D ($599) and Ryzen 7 9800X3D have remained consistently in stock throughout most of the year. These CPUs have been easier to source even during the 9950X3D drought, offering excellent alternatives for high-performance users and budget-conscious gamers.

The 9800X3D, in particular, has earned praise as the current “sweet spot” for gaming builds, offering 8 cores, 3D V-Cache, and Zen 5 architecture—all at a more accessible price point. Reviews highlight it as a top-tier gaming CPU without the premium price tag of its bigger siblings.

Why Supply Has Recovered

Several key factors have helped AMD stabilize availability. One major reason is Intel’s underwhelming Arrow Lake launch, which pushed more buyers toward AMD and forced the company to rapidly respond with higher output. AMD also announced plans to expand manufacturing by utilizing TSMC’s new Arizona plant for future production, signaling long-term supply chain improvements.

In addition, AMD’s streamlined logistics and wider retail partnerships have helped reduce bottlenecks, ensuring more consistent supply worldwide. The result is a vastly improved shopping experience for consumers across North America, Europe, and Asia.

3D V-Cache Technology: Still AMD’s Gaming Trump Card

All three Ryzen 9000 X3D CPUs utilize AMD’s advanced 3D V-Cache technology, which stacks extra L3 cache vertically to improve performance in cache-heavy workloads like gaming. It’s especially effective in titles that reuse large datasets rapidly, such as AAA open-world and competitive multiplayer games.

The thermal and architectural engineering required for this stacked cache system reflects AMD’s growing lead in gaming-specific CPU design. Combined with power efficiency gains from Zen 5, these CPUs remain among the top recommendations in 2025.

Frequently Asked Questions

Is the AMD Ryzen 9 9950X3D still hard to find?

No. While it was hard to find immediately after launch, the 9950X3D is now available at major retailers thanks to improved supply from AMD. You no longer need to rely on stock alerts or scalper listings.

Which Ryzen CPU offers the best value for gaming?

The Ryzen 7 9800X3D is widely regarded as the best value option for gamers. It delivers excellent performance in most titles while remaining affordable and easy to find.

Why did AMD CPUs face shortages initially?

Initial shortages were driven by high demand, limited launch allocations, and excitement around AMD’s second-generation 3D V-Cache chips. These factors combined with scalping to create a scarcity window in March–April 2025.

Are AMD’s supply issues resolved now?

Yes. AMD has resolved the bulk of its supply issues and has committed to ongoing production increases. All three Ryzen X3D CPUs are now reliably stocked across major retailers.