Small business owners need reliable accounting software to manage their finances effectively. The right software helps track income, expenses, and prepare for tax season. It also allows business owners to make informed financial decisions.

Many accounting software options exist for small businesses. These range from free basic tools to premium solutions with advanced features. The best choice depends on factors like business size, budget, and specific needs. Some programs excel at invoicing, while others offer robust inventory tracking or multi-user capabilities.

Comparing Accounting Software for Your Small Business

Key Features to Consider

Small business accounting software helps manage finances efficiently. These tools offer features like expense tracking, invoicing, and financial reporting. When choosing software, consider these factors:

- Ease of use: The software should be easy to learn and use, even for those without accounting experience.

- Pricing: Choose a plan that fits your budget and offers the features you need.

- Features: Consider features like invoicing, expense tracking, bank reconciliation, and reporting.

- Integrations: Ensure the software integrates with your other business tools, like your bank account and CRM.

- Scalability: Select software that can grow with your business.

- Customer support: Look for a provider with good customer support options in case you need help.

Top-Rated Accounting Software

Here are some of the best accounting software options for small businesses:

| Rank | Software | Best for | Key Features | Price (starting) |

|---|---|---|---|---|

| 1 | Quickbooks Online | Overall, Ease of Use | Invoicing, expense tracking, bank reconciliation, reporting | $30/month |

| 2 | Xero | Small businesses, freelancers | Invoicing, expense tracking, bank reconciliation, inventory management | $13/month |

| 3 | Zoho Books | Micro businesses, value pricing | Invoicing, expense tracking, bank reconciliation, project management | $10/month |

| 4 | FreshBooks | Invoicing, self-employed | Invoicing, expense tracking, time tracking, project management | $17/month |

| 5 | Wave Accounting | Free option, basic needs | Invoicing, expense tracking, bank reconciliation | Free |

Choosing the Right Software

The best accounting software for your business will depend on your specific needs and budget. Consider your business size, required features, and accounting knowledge. If you’re unsure which software to choose, try a free trial or a free plan to test it out. You can also consult with an accountant or bookkeeper for recommendations.

Additional Resources for Small Businesses

Here are some other tools and resources that can help you manage your small business finances:

- Business bank accounts: Choose a bank account designed for small businesses with features like online banking and low fees.

- Credit cards: Use a business credit card to track expenses and earn rewards.

- Payroll services: Use a payroll service to automate payroll processing and tax filings.

- Invoice templates: Use invoice templates to create professional invoices quickly.

- Financial calculators: Use financial calculators to calculate loan payments, interest rates, and other financial metrics.

Key Takeaways

- Accounting software streamlines financial management for small businesses

- Options range from free basic tools to premium solutions with advanced features

- The best choice depends on specific business needs, size, and budget

Top Choice for Small Business Accounting

Running a small business is no easy feat, and managing your finances effectively is crucial for success. Choosing the right accounting software can save you time, reduce errors, and provide valuable insights into your business’s financial health. This guide breaks down the top-rated accounting software options available, highlighting their key features, pricing, and ideal use cases. We’ll also explore the essential factors to consider when making your decision, such as ease of use, scalability, and integrations. Whether you’re a freelancer, a micro-business, or a growing company, finding the perfect accounting software can streamline your financial processes and free you up to focus on what you do best.

QuickBooks Online by Intuit

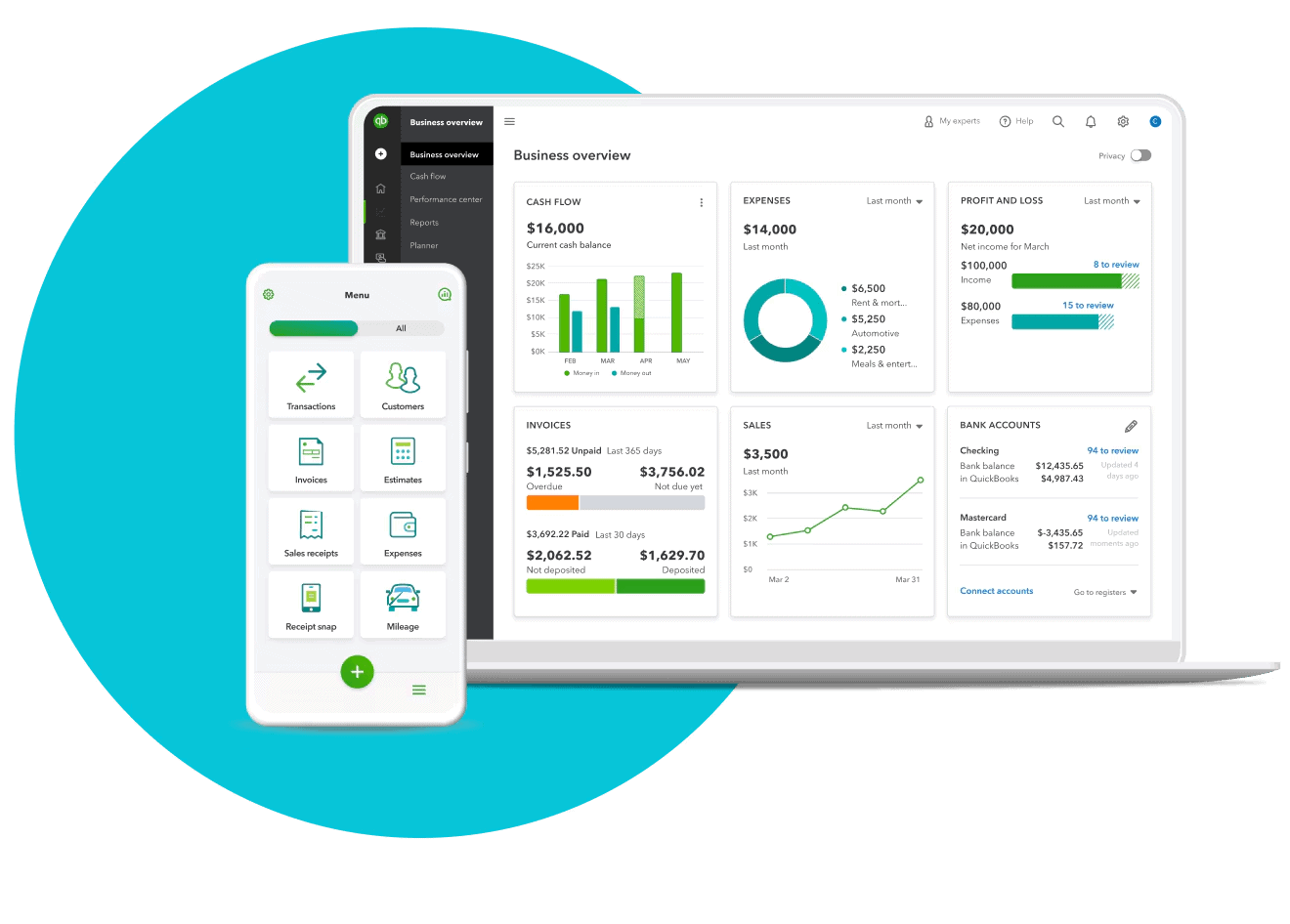

QuickBooks Online offers robust features for small businesses. It excels in contact management and transaction forms. The software provides strong inventory tracking and time management tools.

Users can access many customizable reports. QuickBooks Online supports projects, payroll, and various add-ons. It integrates with many third-party apps, expanding its functionality.

The mobile apps are useful, though some features are hidden. While powerful, QuickBooks Online can be pricey for some users.

• Pros:

- Detailed financial tracking

- Extensive reporting options

- Wide range of integrations

• Cons:

- Higher cost

- Some mobile limitations

Top Choice for Team Collaboration

Xero: Robust Features for Multiple Users

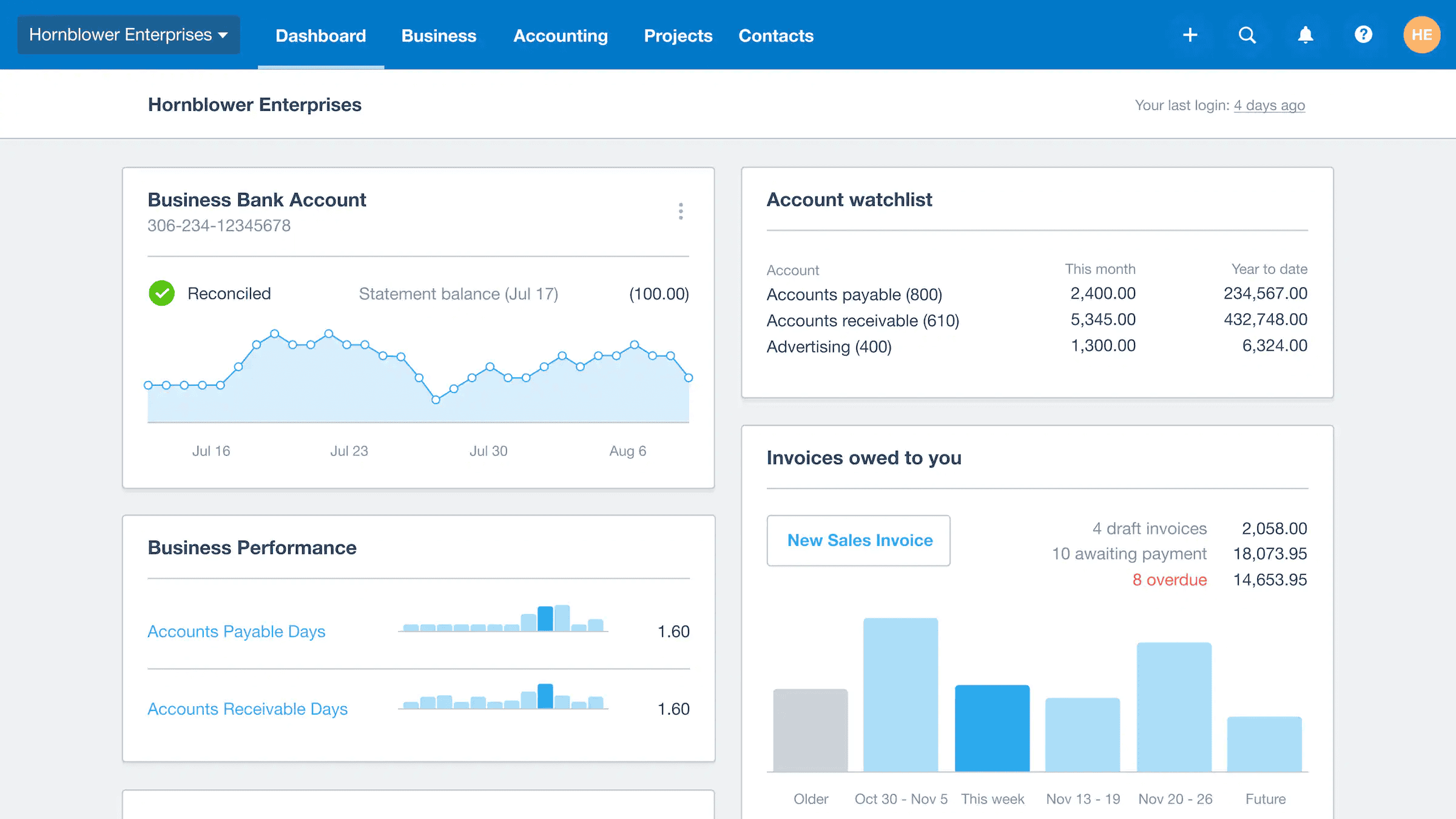

Xero stands out as a powerful accounting solution for businesses with multiple users. Its comprehensive set of tools covers essential financial tasks. The software now includes a useful inventory management feature. For companies needing payroll services, Xero integrates smoothly with Gusto.

Users benefit from Xero’s excellent online support resources and well-designed mobile apps. These features enable team members to work efficiently from various locations. However, some users may find linking time entries to projects a bit cumbersome. Modifying transaction templates can also present challenges for some teams.

Despite minor drawbacks, Xero’s strengths in multi-user functionality make it a top pick for collaborative accounting. Its features support smooth teamwork and efficient financial management across different roles and departments.

Top Choice for Service Firms

FreshBooks Accounting Software

FreshBooks offers a user-friendly platform for service-based businesses. It includes useful features like time tracking and project management. The mobile apps are well-designed and easy to use.

Key Features:

- Time tracking tools

- Project management capabilities

- Retainer options

Pros:

- Intuitive interface

- Helpful mobile apps

Cons:

- Extra fees for team members

- Limited inventory tracking

FreshBooks caters to service providers with its project accounting tools. Users can easily track time and manage projects within the software.

Top Tools for Stock Management

Sage 50 Accounting

Sage 50 Accounting offers robust features for businesses needing detailed inventory control. Its dashboard provides quick insights into stock levels and movements. The software includes:

- Comprehensive record-keeping forms

- Advanced tools for managing stock

- Extensive reporting options

- Integration with Microsoft 365 Business

Sage 50 runs on Windows systems only. Some users may find certain interface elements outdated. The lack of mobile apps limits on-the-go access to inventory data.

Top Choice for Billing

Wave Accounting

Wave offers a user-friendly platform for small businesses. It provides essential features for invoice management and transaction tracking. The software supports multiple currencies, which is helpful for international transactions.

Wave has improved its mobile apps, enhancing on-the-go functionality. However, some previously free features now come at a cost. The software lacks time tracking and project management tools.

Top Picks for Expanding Enterprises

Zoho Books: Feature-Rich Accounting Solution

Zoho Books offers a robust platform for growing businesses. It boasts:

- Extensive customization options

- Multi-currency and language support

- Comprehensive reporting tools

- User-friendly mobile apps

The software’s depth may challenge smaller firms. Some users note:

- Time tracking tied to projects

- Certain features require add-ons

Zoho Books scales well with business growth, making it a solid choice for companies eyeing expansion.

Budget-Friendly Options

Patriot Software Accounting

Patriot Software Accounting offers a cost-effective solution for small businesses. The software boasts an easy-to-use interface and robust mobile access. Users appreciate the ample support options available.

Key features:

- Competitive pricing

- User-friendly design

- Strong mobile functionality

While Patriot lacks time tracking and inventory management, it provides essential accounting tools. The software may reference some advanced concepts, which could challenge new users. Contact and product records have limited fields.

Top Choice for Independent Entrepreneurs

QuickBooks for Solo Operators

QuickBooks for Solo Operators offers a user-friendly interface with a clear dashboard. It excels in creating invoices and managing income tax tasks. The mobile apps work well on various devices.

Key features:

- Easy-to-use interface

- Strong invoicing tools

- Tax management assistance

- Effective mobile applications

Limitations:

- Few report options

- No supplier or bill tracking

- Basic record templates

QuickBooks for Solo Operators stands out for its simplicity and focus on essential tasks for individual business owners.

Selecting Top-Tier Accounting Software for Small Businesses

Our evaluation process for small business accounting software focuses on key factors. We assess ease of use, feature set, and pricing to determine the best options. Hands-on testing helps us gauge real-world performance.

The top contenders offer varied pricing tiers:

- Budget-friendly: $16-$20/month

- Feature-rich: $30-$99/month

These cater to different business sizes and needs. Freelancers might opt for simpler tools, while growing companies need more robust solutions.

Key features we look for include:

- Invoicing

- Expense tracking

- Financial reporting

- Payroll integration

- Real-time overview of finances

We also consider:

- Customization options

- Scalability

- Customer support quality

- Integration with other business tools

Our goal is to help small businesses find software that streamlines their accounting processes and supports growth.

What Small Business Accounting Services Offer

Small business accounting services provide essential financial management tools. These services help business owners track income, expenses, and cash flow. They make it easier to handle basic tasks like paying bills and recording revenue.

Accounting software offers features to streamline financial processes:

• Invoice creation and tracking

• Bill payment management

• Financial reporting

• Tax preparation assistance

These tools give business owners insights into their company’s financial health. They can quickly check profitability, monitor tax obligations, and assess funding needs for new equipment or projects.

Many services offer:

- Real-time financial data updates

- Customizable reports

- Mobile access for on-the-go management

Business owners can grant staff appropriate access levels to financial information. This allows for efficient remote work and collaboration.

With these services, companies can:

- Make informed decisions about investments

- Plan for upcoming expenses

- Identify areas for cost savings

By automating routine tasks, accounting services free up time for business owners to focus on growth and strategy. They provide the financial clarity needed to guide a company towards success.

Setting Up Your Business Accounting Software

Starting with accounting software for your business can be quick or take several hours. Many providers offer free trials or demo accounts. The setup time and monthly cost often increase with the number of features you need.

Begin by creating an account and entering basic business details. Some software encourages you to create a sample transaction right away. It’s smart to explore the settings early on. You can usually turn specific features on or off to tailor the interface to your needs.

Connecting your online financial accounts is a key step. The software typically imports recent transactions, usually from the past 90 days. This process may require extra security steps due to increased bank safeguards.

If you want to accept credit card or bank payments from customers, you’ll need to set up a payment processor. Options like PayPal or Stripe are common, but they come with transaction fees that vary between services.

You can start using the software with minimal setup, adding customers, products, and vendors as you go. Alternatively, you might prefer to build your databases upfront. Most services allow you to import existing lists from spreadsheets, though you may need to adjust the field configurations.

Once you start entering data, your dashboard will display real-time financial information. This includes:

- Account balances

- Income and expense charts

- Pending invoices and bills

These dashboards are interactive, linking to pages with more details and action options.

Here are some key steps for setting up your accounting software:

- Choose a software that fits your business size and type

- Sign up for an account

- Enter your business information

- Customize your settings and preferences

- Connect your bank and credit card accounts

- Set up payment processing if needed

- Import or enter your existing financial data

- Familiarize yourself with the dashboard and features

When selecting software, consider these factors:

| Factor | Importance |

|---|---|

| Ease of use | High |

| Cost | Medium |

| Features | High |

| Integration capabilities | Medium |

| Customer support | High |

| Security | Very High |

Small business accounting software can help track income, generate reports and invoices, and simplify tax preparation. Popular options like Xero offer features such as sales tracking, purchase management, and inventory control.

Remember, the setup process is an investment in your business’s financial health. Taking the time to configure your software correctly can save hours of work later and provide valuable insights into your company’s finances.

Top Free Accounting Apps for Small Businesses

Free accounting software options have evolved. Wave, once a top choice, now offers two versions. Wave Starter is free but lacks some key features. It charges $8 monthly for receipt scanning, which other apps provide at no cost. Wave Pro, at $16 per month, includes all tools. Payment and payroll services cost extra.

Zoho Books presents a strong free version. It suits businesses using other Zoho products or planning to grow. The free plan includes:

- Client management

- Expense and mileage tracking

- Multilingual invoicing

- Recurring invoices

- Online payments

- Automatic payment reminders

- Reports

Users can import bank and credit card statements but can’t set up direct connections to financial institutions.

The IRS has expanded its Direct File program. It allows free federal tax filing in 24 states. Eligibility depends on income, deductions, and credits. This differs from the IRS Free File program, a long-standing partnership with commercial software providers.

When choosing a free accounting app, consider these factors:

- Features needed

- Business size and growth plans

- Integration with other software

- Ease of use

- Customer support

A comparison table of top free accounting apps:

| App | Best For | Key Features |

|---|---|---|

| Wave Starter | Basic needs | Invoice creation, income/expense tracking |

| Zoho Books Free | Growing businesses | Client management, expense tracking, invoicing |

| IRS Direct File | Simple tax returns | Free federal filing in eligible states |

Small business owners should evaluate their specific needs before selecting an app. Some may find free versions sufficient, while others might need paid upgrades for advanced features. Regular review of accounting needs ensures the chosen solution continues to meet business requirements as the company grows.

User-Friendly Accounting Software Options

FreshBooks, Solopreneur, and Wave stand out as some of the most user-friendly accounting programs for small businesses. These platforms offer intuitive dashboards and simplified user experiences, making financial management less daunting for non-accountants.

FreshBooks and QuickBooks Online use clear language instead of complex accounting terms. This approach helps users who may not be familiar with traditional bookkeeping jargon. Their dashboards present key financial information in easy-to-understand formats.

Key features of user-friendly accounting software:

- Simple navigation

- Clear data visualization

- Jargon-free interfaces

- Customizable dashboards

- Mobile app compatibility

By choosing software with these attributes, small business owners can manage their finances more effectively without extensive accounting knowledge.

How Accounting Software Streamlines Record Creation

Accounting software simplifies the process of creating and managing records for small businesses. These digital tools allow users to input customer details, product information, and vendor data quickly and efficiently.

Many accounting programs offer customizable record templates. Users can add fields like:

- Customer since date

- Birthdays

- Special preferences

This extra information helps businesses build stronger relationships with clients.

Product and service records are equally important. Well-designed software lets users:

• Enter item descriptions

• Set pricing

• Track inventory levels

Some advanced systems even send alerts when stock runs low.

The true power of accounting software lies in its ability to reduce repetitive data entry. Once a record is created, the information becomes readily available throughout the system. This feature saves time and reduces errors.

For example, when creating an invoice, users can simply select a customer from a drop-down list. The software automatically fills in the address, contact details, and other relevant information.

Inventory tracking is another key benefit. By maintaining accurate stock levels, businesses can:

- Avoid stockouts

- Identify popular items

- Make informed purchasing decisions

Some accounting programs go beyond basic record-keeping. They offer mileage tracking features, which are particularly useful for businesses with mobile employees or frequent travel expenses.

These tools often integrate with GPS systems or mobile apps to automatically log trips. This functionality ensures accurate expense reporting and can be valuable for tax purposes.

By centralizing all business records, accounting software provides a comprehensive view of a company’s financial health. Users can quickly access historical data, analyze trends, and make informed decisions about their operations.

Transaction Types Supported by Accounting Software

Small business accounting software typically handles various financial transactions. Most programs support basic functions like creating bills, estimates, and invoices. Some offer more advanced features.

Certain platforms allow users to generate:

• Credit notes

• Purchase orders

• Sales receipts

• Statements

These tools often include pre-made templates. Users simply fill in the required information and select from dropdown menus for customer names and product details.

Advanced features can save time and improve accuracy for businesses with complex financial needs.

How Accounting Software Handles Completed Invoices

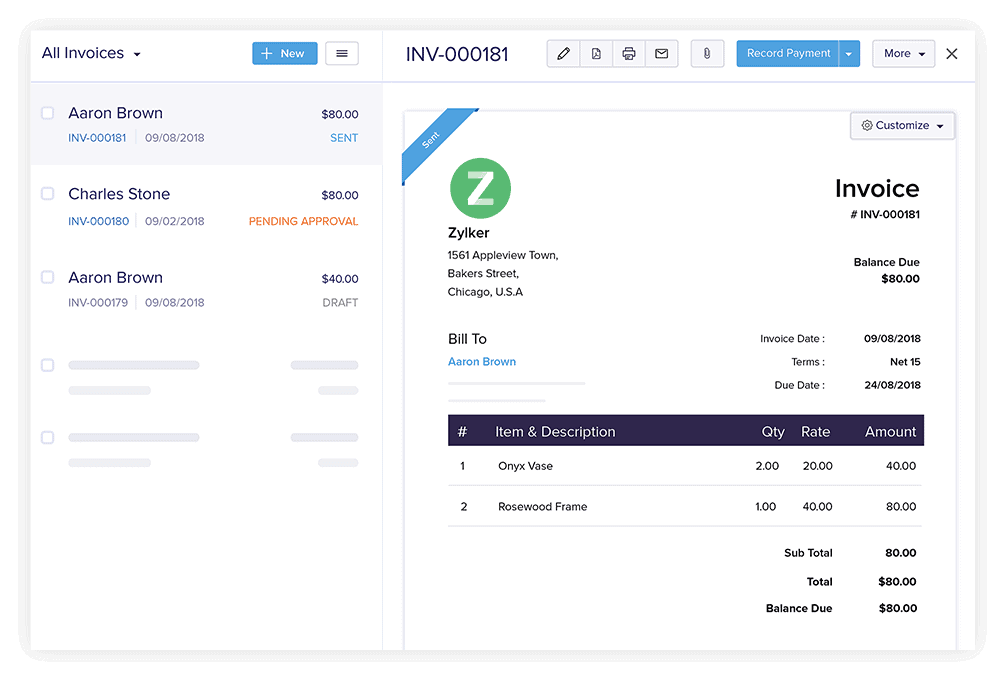

Transaction tracking in accounting software offers various options for managing completed invoices. Users can save invoices as drafts or finalize them for printing or emailing. Many programs integrate with payment processors, allowing customers to pay via credit card or bank transfer directly from the invoice.

Some key features include:

• PDF creation

• Invoice copying

• Payment recording

• Recurring invoice setup

These tools streamline the invoicing process and improve cash flow management. Small business owners can customize invoices to match their branding and include payment instructions. The software often provides reminders for overdue payments and generates reports on outstanding invoices.

Can Accounting Software Handle Your Expenses and Bills?

Accounting software helps businesses track their spending. Many programs let users enter and pay bills directly. They also help monitor other purchases to keep finances in check.

Some key features include:

• Mobile receipt capture

• Automatic data extraction

• Expense form creation

Users can snap photos of receipts with their phones. The software then uploads these images. Some apps go further:

- They attach receipts to expense forms

- They use OCR to pull out important details

OCR extracts data like:

- Amount spent

- Date of purchase

- Vendor name

This technology saves time on data entry. It also reduces errors. By automating expense tracking, businesses can better control their spending.

Importing Financial Data: A Key to Efficient Accounting

Expert Picks for Accounting Software

Regularly importing transactions and bank balances is crucial for small business accounting. This practice streamlines financial management and provides real-time insights into cash flow.

Many accounting software options offer dashboard displays of account balances. These dashboards give business owners a quick overview of their financial status. Online registers show cleared transactions from connected accounts, as well as manually entered items.

Imported transactions can be categorized for better expense tracking. Common categories include:

- Office supplies

- Travel expenses

- Utilities

- Marketing costs

Most software attempts to auto-categorize transactions. Users can adjust these categories as needed. Accurate categorization leads to more precise financial reports and tax returns.

Transaction matching is another useful feature. The software often suggests matches between invoices and payments. This function helps maintain accurate records and reduces manual data entry.

Additional transaction management tasks include:

- Adding notes to transactions

- Splitting transactions across multiple categories

- Reconciling accounts with bank statements

These practices help maintain clean, organized financial records. They also support informed decision-making by providing up-to-date financial information.

Regular data imports reduce errors and save time. They allow business owners to focus on strategic tasks rather than manual data entry. This efficiency can lead to improved financial management and business growth.

Using Reports to Boost Business Performance

Financial reports are vital tools for small businesses. They offer valuable insights into company performance and financial health. Small business accounting software can generate these reports quickly and easily.

Common reports include:

- Sales tax summaries

- Profit and loss statements

- Customer purchasing trends

- Unbilled expenses and services

- Product and service sales analysis

- Accounts receivable aging

These reports help business owners make informed decisions. For example, a product sales analysis might reveal which items are most popular, guiding inventory and marketing choices.

More complex reports like balance sheets and cash flow statements are crucial for securing loans or attracting investors. While software can create these, professional interpretation may be needed to fully understand their implications.

Regular reporting offers several benefits:

- Identifying cash flow issues early

- Tracking business growth over time

- Spotting trends in customer behavior

- Optimizing inventory management

- Improving budgeting and forecasting

By utilizing these reports effectively, businesses can:

- Reduce costs

- Increase revenue

- Enhance operational efficiency

- Make data-driven strategic decisions

It’s important to review reports regularly and act on the insights they provide. This proactive approach can lead to significant improvements in overall business performance.

Mobile Access for Accounting Software

Many accounting software providers offer mobile apps for on-the-go financial management. These apps allow business owners to perform key tasks from their smartphones.

Common mobile features include:

• Viewing financial dashboards

• Creating and sending invoices

• Capturing expense receipts

• Accepting payments

• Checking account balances

While mobile apps can’t replace desktop software entirely, they provide convenience for basic tasks. Users can quickly check financial status or record transactions without a computer.

Some limitations of mobile accounting apps:

- Smaller screen size makes viewing reports difficult

- Data entry can be cumbersome on phone keyboards

- Advanced features may be missing from mobile versions

Patriot Software Accounting offers a unique approach with browser-based mobile access. This allows for more comprehensive features compared to standalone apps.

When choosing accounting software, consider mobile capabilities if you need to manage finances away from your desk. Test the mobile app to ensure it meets your on-the-go needs.

Accounting Services: Support and Assistance Options

Small business accounting software providers offer various forms of help to users. Many platforms provide chat, email, and phone support for quick problem-solving. Some include in-app guidance and searchable help articles.

Certain companies go further with their offerings:

QuickBooks Live: This add-on to QuickBooks Online connects users with a dedicated accounting expert through one-way video chat or email. Services include:

• Custom setup assistance

• Transaction monitoring and categorization

• Account reconciliation

• Monthly book closing

• Report generationWave: Offers paid bookkeeping and coaching services.

These enhanced services aim to:

• Prevent errors

• Ensure tax compliance

• Prepare financial reports

• Answer user questions during business hours

By providing expert support, these services help small businesses manage their finances more effectively and prepare for tax season with greater confidence.

Top Accounting Software for Small Businesses

QuickBooks Online is a popular choice for small businesses. It offers strong bookkeeping features and scales well as companies grow. The software integrates with many third-party apps, expanding its functionality.

FreshBooks excels for service-based businesses. It provides easy-to-use invoicing and time tracking tools. The platform also offers project accounting capabilities, which help manage costs and profits for specific jobs.

Xero stands out for its inventory management and multi-user access. It’s well-suited for businesses with complex accounting needs or those requiring collaboration among team members.

Zoho Books offers a comprehensive suite of financial management tools. It integrates seamlessly with other Zoho products, creating a unified business software ecosystem.

For budget-conscious entrepreneurs, Wave provides free basic accounting and invoicing features. While it may lack advanced capabilities, it covers essential needs for many small businesses.