Personal finance apps have revolutionized how people manage their money, and we saw the closure of a big one in March of 2024 with the closure of Mint.com. So who is the best as we head into 2025 and what are the best replacements for Mint? This article will guide you toward finding which personal finance app is the best for you and your needs this year.

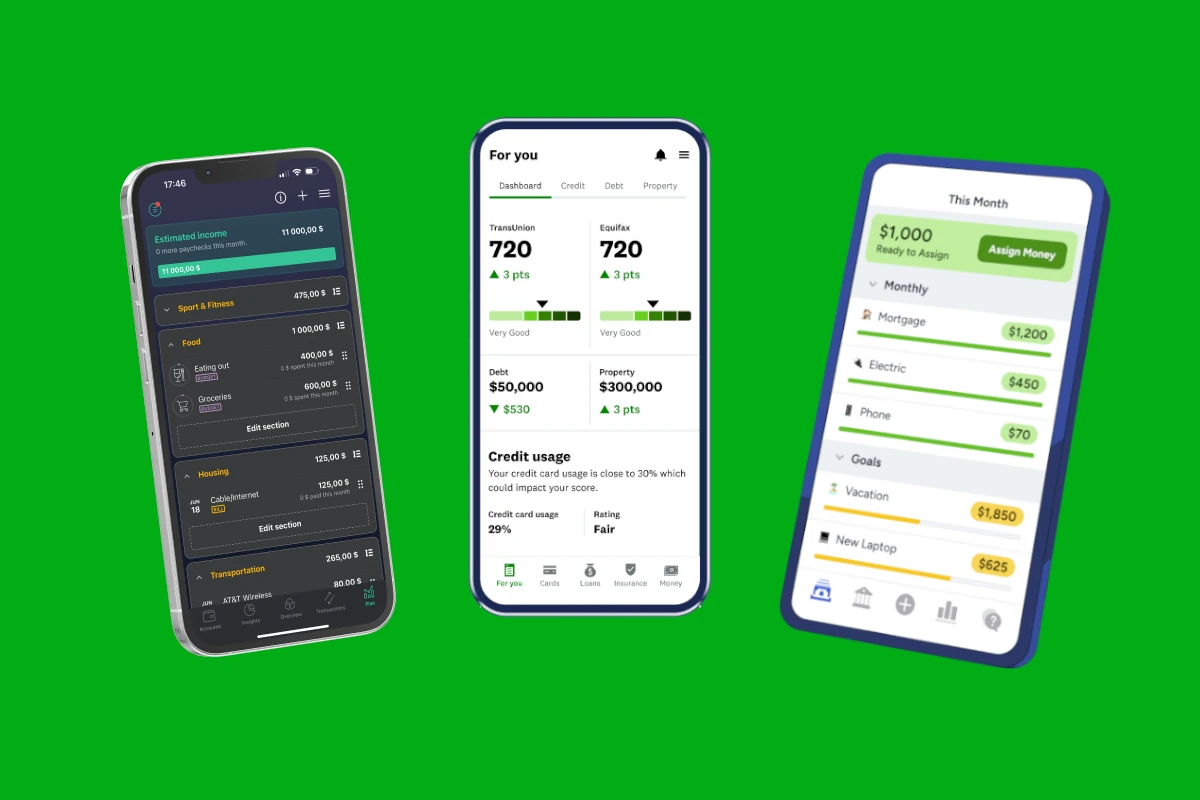

These digital tools offer a range of features to help users track spending, set budgets, and reach financial goals. From basic expense trackers to comprehensive financial planning platforms, there’s an app for every need and level of financial expertise.

The best personal finance apps combine user-friendly interfaces with powerful features. They sync with bank accounts, credit cards, and investment portfolios to provide a real-time overview of one’s financial situation. Some apps focus on specific areas like budgeting or investing, while others offer a more holistic approach to financial management. The choice of app depends on individual needs, financial goals, and comfort with technology.

Top Personal Finance Apps for Budgeting and More

What Makes a Great Personal Finance App?

A good personal finance app helps you track your money. It should be easy to use and safe. The app should also connect to your bank accounts. Some apps have extra features, like budgeting tools or ways to invest.

Top Personal Finance App Options

Many different personal finance apps are available. Here are three popular choices:

1. Personal Capital

Personal Capital is a good choice if you want to grow your wealth. It has tools to help you track your spending, plan for retirement, and analyze your investments. Personal Capital also offers free financial advice from real people.

2. YNAB (You Need a Budget)

YNAB is a popular budgeting app. It helps you make a plan for every dollar you have. YNAB teaches you good budgeting habits. It has lots of online resources to help you learn.

3. PocketGuard

PocketGuard is a simple budgeting app. It helps you track your spending and find ways to save money. PocketGuard is easy to use, even if you are new to budgeting.

4. Credit Karma

Credit Karma provides free credit scores and reports. It also offers tools to help you monitor your credit, find loans, and get personalized financial recommendations. Credit Karma has also integrated some of the features from Mint, like tracking your spending and net worth.

Choosing the Right App for You

The best app for you depends on your needs. Think about what you want the app to do. Do you want to create a budget? Do you want to track your investments? Do you want to get help from a financial advisor?

Here is a table summarizing the pros and cons of each app:

| Rank | App | Pros | Cons |

|---|---|---|---|

| 1 | Personal Capital | Free financial advice, good investment tools, helps with retirement planning | Not as good for detailed budgeting |

| 2 | YNAB | Excellent budgeting features, teaches good habits, lots of learning resources | Can be expensive |

| 3 | PocketGuard | Simple and easy to use, helps you find ways to save | Fewer features than some other apps |

| 4 | Credit Karma | Free credit scores and reports, credit monitoring tools, financial recommendations | Limited budgeting features compared to Mint |

Other Great Options

Many other personal finance apps are available. Some other popular choices include:

- Mvelopes

- Honeydue

- Zeta

Tips for Using Personal Finance Apps

- Connect all your accounts. This gives you an accurate picture of your finances.

- Check the app often. Staying engaged helps you manage your money well.

- Use the features. Most apps have helpful tools, like budgeting and investment tracking.

Keeping Your Information Safe and Robo-Advisors

When choosing an investment app, it’s essential to select a reputable one that has strong security measures in place. Look for features such as two-factor authentication, which helps protect your financial information. Robo-advisors offer a modern way to receive investment advice by using algorithms to build and manage your investment portfolio. They are often more affordable than traditional financial advisors, making them an excellent option for individuals who are new to investing. Some well-known robo-advisors include Betterment, Wealthfront, and SoFi.

What Happened To Mint.com?

Mint.com was a popular personal finance app that closed in March 2024. Intuit, the company that owned Mint, decided to merge its functionalities into Credit Karma. While Credit Karma offers some similar features, some Mint users may be looking for alternative apps.

Former Mint users may want to consider Personal Capital, YNAB, or PocketGuard, depending on their specific needs and preferences.

Key Takeaways

- Personal finance apps offer various tools for budgeting, expense tracking, and financial planning

- The best apps sync with multiple accounts and provide real-time financial overviews

- Users can choose apps based on their specific financial needs and goals

Top Choices

The best personal finance apps can revolutionize how you manage your money. These apps provide a convenient and efficient way to track spending, create budgets, and plan for your financial future. With features like automated alerts, investment tracking, and personalized financial advice, these apps empower you to take control of your finances. Whether you’re a budgeting novice or a seasoned investor, there’s an app to suit your needs. In this article, we’ll explore some of the top-rated personal finance apps available, comparing their pros and cons, and highlighting key features to help you choose the best one for your financial goals.

Simplifi: Streamlined Money Management

Simplifi offers a user-friendly dashboard for easy financial tracking. Its robust transaction categorization and flexible budgeting tools help users stay on top of their spending. The app provides detailed reports and excellent mobile functionality.

Simplifi charges a reasonable subscription fee. While it excels in many areas, its savings goals feature lacks direct account linkage. Despite this minor drawback, Simplifi remains a strong contender for those seeking comprehensive personal finance software.

Top Choice for Advanced Users

Quicken Classic: Feature-Rich Finance Tool

Quicken Classic offers a comprehensive set of financial management tools. It boasts in-depth transaction tracking and customizable reports. Users can access their data through a companion website. The software excels in investment tracking.

Pros:

- Extensive finance features

- Flexible transaction management

- Strong reporting capabilities

- Advanced investment tools

Cons:

- Primarily desktop-based

- Interface can be challenging

Quicken Classic suits users who need detailed financial control and don’t mind a steeper learning curve.

Fresh Budgeting Approaches

You Need A Budget (YNAB)

YNAB offers a unique take on budgeting. It uses a method that assigns every dollar a job. This approach helps users think differently about their money.

YNAB’s key features:

- Flexible budgeting system

- Educational resources

- Account sharing for up to 6 people

- User-friendly interface

YNAB requires time to learn. It lacks investment tracking and bill pay features. But its fresh approach may help users stick to their budget long-term.

Top Choice for Young Savers

Greenlight: Smart Money Management for Kids

Greenlight offers a comprehensive financial platform for children. Parents get strong oversight tools. The app supports both savings and investment features. It includes safety measures for families. Support is available round-the-clock.

Key benefits:

- Parent-controlled spending limits

- Investment options for kids

- Family protection features

- Always-available customer care

The top-tier plan carries a higher monthly cost.

Top Options for Independent Workers

Monarch Money

Monarch Money offers valuable features for self-employed individuals. The platform provides detailed setup tools and flexible transaction management. Users can carry over unused budget funds to the next period.

The interface is clean and fast. Monarch Money allows unlimited collaborators on accounts. This feature benefits freelancers working with teams or clients.

The software integrates bookkeeping functions. It helps track income and expenses efficiently. However, Monarch Money has a higher price point than some alternatives.

Monarch Money does not include credit score monitoring. Users seeking this feature may need to look elsewhere.

Top No-Cost Personal Money Management Tool

NerdWallet’s Financial Assistant

NerdWallet offers a free personal finance app with useful features. It pulls in financial transactions automatically. Users can check their credit score, net worth, and cash flow.

The app provides lots of educational content about money. Ads are minimal and don’t disrupt the experience. However, custom budgets can’t be created. The mobile version has less written content. Transaction details are basic.

• Pros:

- Free to use

- Automatic transaction importing

- Credit score and net worth tracking

- Extensive financial education

• Cons:

- Can’t make custom budgets

- Limited mobile app content

- Basic transaction info

NerdWallet helps users learn about money while tracking their finances. It’s a solid choice for those wanting a free, ad-light tool to monitor their overall financial picture.

Finance Simplified for the Overwhelmed

PocketGuard: Your Financial Companion

PocketGuard offers a user-friendly approach to money management. The app’s creative design makes budgeting less daunting. It excels in basic budgeting and transaction tracking.

Key features:

- Easy-to-use interface

- Strong customer support

- Efficient expense categorization

PocketGuard lacks investment tools and credit score monitoring. The app’s higher price point may deter some users. Despite this, it remains a solid choice for those seeking straightforward financial guidance.

Optimal Strategies for Debt Elimination

Rocket Money: A Financial Fitness Tool

Rocket Money offers a sleek interface with easy-to-use navigation. Users can track their net worth and credit scores effortlessly. The app excels at identifying and helping cancel unwanted subscriptions. Its visual aids, like charts and tables, make financial data easy to grasp.

The premium subscription can be costly. Investment tracking features are limited. Traditional financial reports are not available. Rocket Money’s fee analyzer helps users spot hidden charges in their accounts.

Credit Score Tracking Options

Credit Karma’s Free Monitoring

Credit Karma offers free credit score monitoring for users. The service includes bill tracking and payment features. Users can access save and spend accounts, as well as a Credit Builder tool.

Credit Karma recently added Intuit Assist, enhancing its capabilities. The platform provides solid support options for users needing help.

While Credit Karma excels in many areas, it has some limitations:

- Minimal transaction details

- No budgeting tools

The service frequently recommends financial products to users. This can be helpful for some, but may feel intrusive to others.

Top Choices for Investment Management

Empower’s Financial Tools

Empower offers free investment tracking and personalized retirement planning. Users can monitor their portfolios and get feedback on their investments. The platform includes a robo-advisor and a fee-based advisory option for those seeking more guidance.

Empower’s personal dashboard gives users a clear view of their investment accounts. However, the platform lacks tools for daily money management and credit health monitoring. Users can’t manually enter transactions, which may limit its usefulness for some investors.

The mobile apps are functional but not outstanding. Despite these drawbacks, Empower remains a solid choice for investors focused on long-term wealth building and portfolio management.

Personal Finance App Security: What You Need to Know

Personal finance apps use strong security measures to protect user data. These apps typically connect to bank accounts, credit cards, and other financial services. They fetch transaction details and balances to display all activities in one place.

To ensure safety, users should take these key steps:

- Create unique login credentials

- Use multi-factor authentication

- Keep personal details private

Robust security protocols are standard in reputable finance apps. When linking accounts, users often need to provide extra security information beyond basic login details. This added layer helps safeguard sensitive data.

Many apps use encryption to protect login information. Some rely on third-party services like Plaid for secure connections to financial institutions.

A password manager can help users create and store strong, unique passwords for each account. This tool is invaluable for maintaining different login details across multiple platforms.

Multi-factor authentication adds an extra security step. While it takes a moment longer to log in, it greatly reduces the risk of unauthorized access. This feature is especially crucial for finance apps and linked bank accounts.

Users should never share personal information like birth dates or hometowns publicly. Cybercriminals can use these details to gain access to financial accounts.

By following these guidelines, users can enjoy the benefits of personal finance apps while minimizing security risks. Regular updates and staying informed about app security features also contribute to a safer experience.

Top Free Personal Finance Apps

NerdWallet stands out as a leading free personal finance app. It offers a range of features to help users manage their money effectively. The app imports bank account data and handles transactions seamlessly. Users can track their net worth and cash flow by linking their financial accounts.

NerdWallet provides valuable insights into credit scores. It explains how scores are calculated and what factors influence them. While it offers this feature, Credit Karma may provide more detailed credit score analysis.

Key features of NerdWallet include:

- Bank account imports

- Transaction management

- Credit score information

- Net worth tracking

- Cash flow monitoring

The app is supported by ads but maintains a user-friendly interface. These ads do not interfere with the app’s functionality. NerdWallet also offers educational content on various personal finance topics. This includes helpful tutorials for users looking to improve their financial knowledge.

What Personal Finance Apps Can Do for You

Monitor Financial Activity

Personal finance apps allow users to track transactions across multiple accounts. They connect to bank accounts and credit cards, providing a centralized view of all financial activity. This unified approach helps users spot unauthorized charges quickly. Many apps categorize spending automatically, though users can adjust categories as needed.

Analyze Spending Patterns

These apps sort expenses into categories, creating visual representations of spending habits. Users can view pie charts and graphs that break down where their money goes. This feature aids in budgeting and tax preparation. Some apps allow custom tags for expenses, useful for tracking specific costs like medical bills or tax-related items.

Provide Financial Snapshots

Most apps feature a dashboard that offers a quick overview of one’s financial status. It typically displays account balances, upcoming bills, and progress towards financial goals. Users can see their net worth, credit score, and comparisons of income versus spending at a glance.

Teach Budgeting Skills

Personal finance apps help users create and stick to budgets. They often use past spending data to suggest realistic budget limits. This feature helps answer the question, “How much do I typically spend each month?” based on actual financial history.

Aid in Goal Setting

Users can set financial objectives within these apps. Common goals include building an emergency fund or saving for a major purchase. The app calculates how much to save monthly to reach the target by a specified date. Some apps link goals to specific accounts for easy progress tracking.

Assist with Retirement Planning

While not all apps focus on long-term planning, some offer retirement planning tools. These may include debt payoff strategies, tax planning features, and comprehensive lifetime financial planning. Some apps provide retirement calculators or offer connections to financial advisors.

Simplify Bill Management

Many apps allow users to track bills and payments. Some offer bill pay features, though this is less common. Users can set up alerts for due dates and mark bills as paid. This helps prevent late payments and associated fees.

Offer Mobile Access

Personal finance apps typically have mobile versions. While these may have reduced functionality compared to desktop versions, they allow users to check balances, view transactions, and add new expenses on the go. This mobile access helps users stay informed about their finances while making purchases.

Promote Financial Education

These apps often include educational resources. Users can access articles, videos, and calculators covering various financial topics. Some apps explain factors affecting credit scores or provide tools to compare debt repayment strategies. This educational aspect helps users make more informed financial decisions.

Customize Financial Insights

Many apps allow users to tailor their experience. They can create custom reports, set personalized alerts, and adjust spending categories. This customization helps users focus on the financial aspects most important to them.

Personal Finance Apps and Credit Score Improvement

Personal finance apps can play a significant role in boosting credit scores. These digital tools provide users with valuable insights into their financial health and offer guidance on improving creditworthiness.

Credit monitoring apps like Credit Karma, NerdWallet, and WalletHub offer free services that track credit scores daily. They pull data from major credit bureaus and give users access to their credit reports. These apps break down the factors affecting credit scores and suggest ways to enhance them.

Key features of credit-boosting apps:

- Daily credit score updates

- Credit report access

- Factor analysis

- Improvement recommendations

Credit-building apps also showcase financial products with attractive terms. These offerings include credit cards and mortgages with competitive interest rates. Users should exercise caution, as frequently opening and closing credit accounts can negatively impact credit scores.

Benefits of using personal finance apps:

- Regular credit score monitoring

- Personalized improvement strategies

- Access to tailored financial products

- Educational resources on credit management

Credit-building apps can help users establish a positive credit history through various methods. Some apps offer credit builder loans, which involve making small, regular payments to improve payment history. Others provide credit monitoring services that alert users to changes in their credit profile.

By leveraging these tools, individuals can gain a better understanding of their credit standing and take proactive steps to improve it. Regular use of personal finance apps can lead to more informed financial decisions and, ultimately, a stronger credit score.

Personal Finance Apps and Net Worth Tracking

Net worth tracking capabilities in personal finance apps vary based on user input. These tools can calculate net worth if given access to all financial accounts. Users control the information shared with the app.

Some people use finance apps solely for:

- Budgeting

- Daily expense tracking

- Income management

- Goal setting

In these cases, users may choose not to disclose all assets. Trust funds or property details can be omitted if desired. The app’s net worth calculation will be incomplete without full financial data.

Users have flexibility in account linking. They can connect only the accounts they want the app to monitor. This allows for privacy and customized financial tracking.